Something for your Espresso: More USD strength is coming!

Morning from Europe.

Macro is hard..

Chinese GDP numbers did surprise markedly above consensus at 5.3% YoY (we penciled in 5.2%), but yet the Asian equity sell-off just continues and Asian FX is generally trading on the back foot as it seems like the USDCNY fixing being lifted above 7.10 is seen as a major negative risk factor for markets.

The Asian FX debasement risk is still considered material, and it has to be good news for energy and precious metals as both work as release valves for the continued downside pressure in Asian FX.

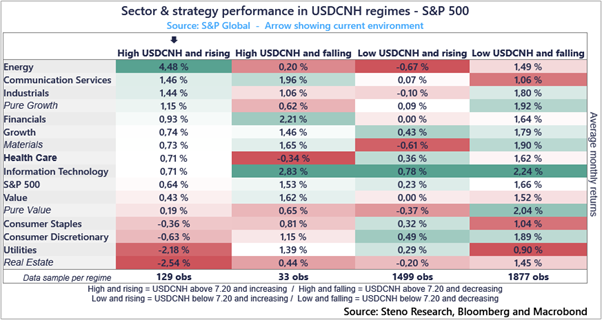

When USDCNH trades at a high level with a rising trend (the leftmost regime in chart 1a), energy, industrials and materials typically trade stronger than the broader equity index, while the utility and real estate sectors suffer. This is a typical real world reflation story, and interesting such a story is now one of USD strength.

Chart 1a: When USDCNH is trading high and rising, buy energy and industrials

The strong Chinese GDP numbers were overshadowed by a continued weakness in Asian FX trends. Energy and metals typically continue to perform in such an environment.

0 Comments