Something for your Espresso: More fuel (for recessionistas)

Morning.

What a bloodbath in energy markets yesterday as the weekly EIA report shocked the demand side assumptions of the oil/gasoline market. This was exactly the bit of breathing room those betting on duration assets and a weaker USD needed, but the question is whether this is only short-term relief. We are not convinced that the direction of travel has turned on those bets (yet).

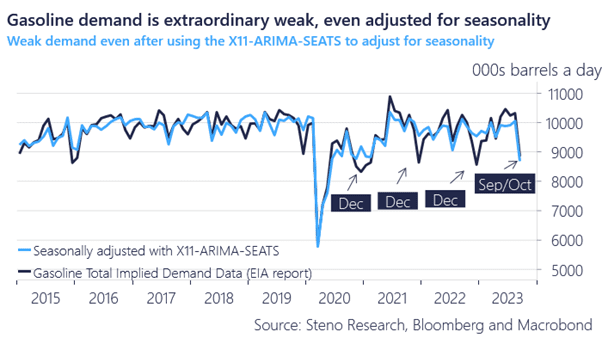

The Bloomberg headline right after the EIA release reported the weakest demand for fuel at the pump in 25 years after taking seasonal comparisons into account.

We have run the implied demand data through a state of the art X11-ARIMA-SEATS filter to assess the actual demand adjusted for seasonality and we have not found a weaker September, since Sep-2000.

Demand has probably plunged around 12-13%, which is very seasonally odd and something that is a major reason for concern unless this proves to be an outlier for various data quality reasons. We do not have any reason to fear a lack of data quality at this stage.

This is a material blow to the oil market bull case, but not necessarily the end to it. We released our full study on the numbers yesterday (Oil Watch: Ouch!).

Chart 1: The weakest september in gasoline markets since 2000

The EIA report shocked oil and gasoline markets and the big question is whether the weak demand is a harbinger for the broader US economy.

0 Comments