Oil Watch: OUCH!

It is no secret that we turned energy bullish early in the summer with pretty accurate timing and made a nice run based on being ahead of the crowd on the call.

We have kept various energy proxies alive in our portfolio and were stopped out of our Refiners spread earlier today due to a material sell-off on the back of the weekly EIA report.

The EIA report is usually not a >1-2 sigma market mover, but oh boy it moved markets today and we find very good reasons why when assessing the data. This is a MUST watch story for everyone involved in global macro and demand side assessments.

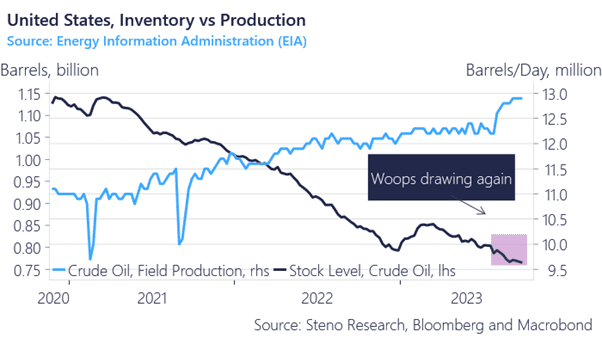

Let’s start with the bullish news. Inventories remain tight even from seasonal standards, so we don’t take much signal value from the minor change of trend after 7 straight weeks of declining inventories, but the implied demand variable was an eye-opener to say the least.

Chart 1: Inventories remain tight

The weekly EIA report revealed seasonal weakness in the demand for Gasoline, but how big of a deal is it? We have taken a deep look at the numbers and only have one word available. “Ouch!”

0 Comments