Something for your Espresso: Melt UP!

Melt UP!

It seems like the tailwinds from USD liquidity have now been paired with growing optimism around the business cycle, which arguably makes for an interesting cocktail for global asset markets. It also rhymes poorly with a large cutting cycle commencing through the spring, which leaves careful assessment of which yield curves to receive of essence.

The Manufacturing PMIs released yesterday mostly underpinned our view of an improving business cycle with especially the French and the US release rhyming with the notion:

From the US PMI release:

“Goods producers signaled the steepest rise in new orders since May 2022, as customer demand improved for a second month running”

From the French PMI release:

“That said, there were reports of demand conditions improving, with production at some manufacturers being boosted by restocking efforts”

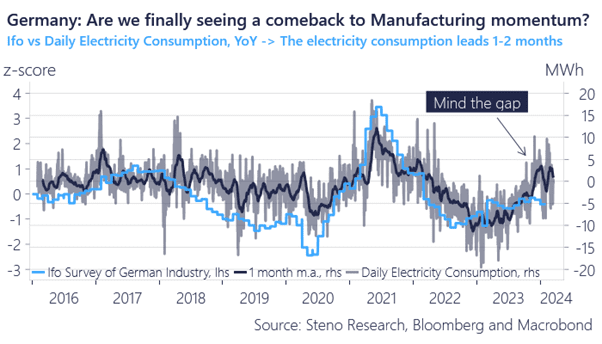

German, on the other hand, remains stuck in the abyss as Manufacturing struggles to rebound. We were caught by surprise by the lack of progress in Germany as our now-casts have seen improving trends in recent weeks.

From the German PMI release:

“As was the case with output, new business in the German private sector declined at the quickest pace for four months in February.”

The IFO survey from Germany released today is likely going to improve and beat consensus, despite the weakness in PMIs, and we will get the full overview of the IFO survey details by Monday.

Chart 1: Germany is actually rebounding in various now-casts

The ongoing AI wave has been spiced up with signs of procyclical data releases and improving fundamentals in Manufacturing and global trade. Where does it leave us globally?

0 Comments