Something for your Espresso: May back in Play?

Morning from Europe!

It’s make or break week for hopes of early spring cuts with the release of the CPI report from January in the US and in the UK.

The 2023 US CPI revisions made for mildly benign reading, and even if it makes little sense to revise December down, it was the ultimately result of the revisions exercise. The revision will not prove to be a biggie, but the risk of a revision up as in 2023 is now OFF the table, making way for a continued dovish FOMC tilt.

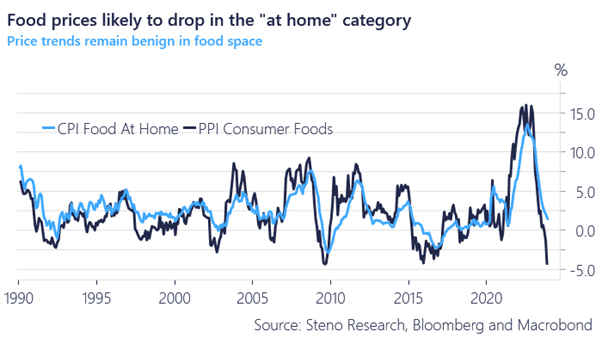

In January, food prices are likely going to print soft as our high-frequency indicators hint at continued price drops in the output prices. The food-at-home category is likely going to drop as a consequence in January.

Chart 1: SOFT US food-flation?

Inflation from the US and UK take center stage. May back in play for both?

0 Comments