Something for your Espresso: March 23 PTSD

Jay Powell made a very strong performance yesterday carefully trying not to allow the market to extrapolate cuts to infinity.

We have summarized the FOMC meeting in a few bullets for you here:

– March is NOT the base case of the committee. It feels more like a 15-20% probability judging from Powells words.

– The data is already good enough to cut. The members just need another quarter or so of the same.

– A likely taper of QT in March. The discussion will be LIVE, according to Powell and the ON RRP does not need to go to zero to start tapering of QT. The USD liquidity trajectory will remain benign from here. Good news for risk assets despite the moves seen after the meeting.

– The Fed acknowledges that things are “picking up” at the margin and Jay Powell even shared anecdotal evidence supporting the notion of a re-acceleration in cyclical growth.

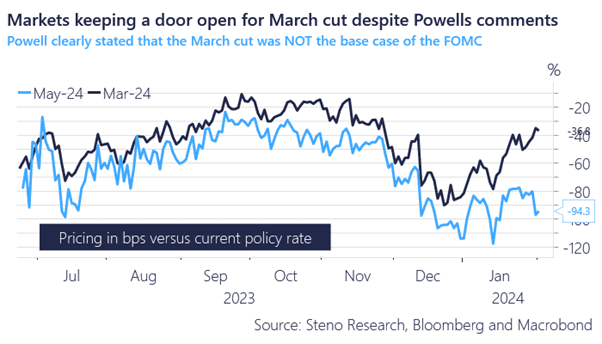

The market still keeps a door open for the March cut despite Powell’s comments. The implied probability is now less than 40% for a March cut, while the May cut is the base-case of markets. We see good reasons to remove the probabilities of a March cut further from the forward pricing.

Chart 1: Market implied probabilities for the future Fed Funds path

The NYCB scare made for an almost PTSD like reaction in cross-asset markets. So far, we consider the story a non-event and put more emphasis on the guidance from Powell.

0 Comments