Something for your Espresso: Is Bailey making a “Powell”?

Morning from Greece!

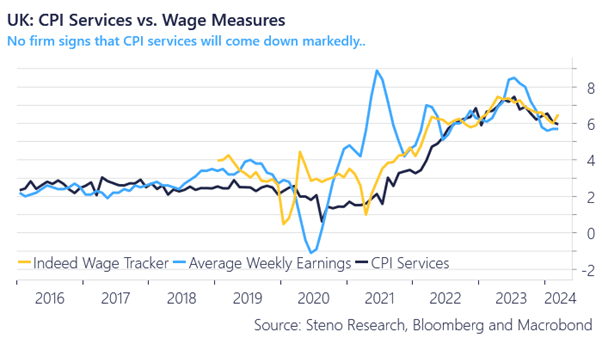

We have highlighted how various early wage indicators suddenly started re-accelerating in the UK and accordingly expected a hot wage inflation print in the monthly job report from the UK.

The average weekly earnings re-accelerated to 5.7% this morning and there are not many comforting signals left for those hoping for a fast descent in the UK Services CPI. Even if the labour market hiring is admittedly cooling, the UK wage component remains WAY too hot to take comfort in and it is looking increasingly hot relative to both US- and Euro area peers studies.

Chart 1: UK services inflation versus wage growth

The GBP rates case is heating up again as both price plans- and wages are probably re-accelerating. Have markets completely mispriced the GBP rates case? It feels VERY reminiscent of late Q4 in the USD rates space.

0 Comments