Something for your Espresso: If you SLOOS, you lose

Morning from Europe.

The overwhelming question to answer this week is whether the melt up will be allowed to continue across asset classes. Jay Powell takes stage on Wednesday and Thursday after the quarterly SLOOS results are revealed later today.

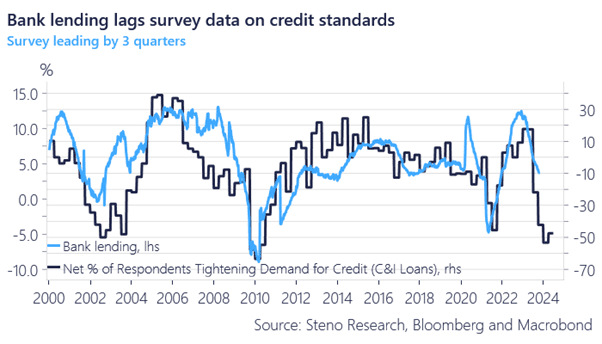

The SLOOS survey already prints in credit contraction territory and judging from the marginal demand for new credit, financial conditions are already (over)tight. The issue is just that it is so damn tricky to wait for the subsequent actual contraction in credit.

The results from the Q3 SLOOS will be out later today and it is probably fair to assume a slight improvement in especially the demand side of the credit equation, but still at levels that remain consistent with a credit contraction in the US in Q4 and Q1.

Chart 1: SLOOS survey is already contractionary

The quarterly SLOOS results are out later today ahead of “empty” data week. Powell will take stage on Wednesday and Thursday. Will he backpaddle if the melt up continues?

0 Comments