Something for your Espresso: Fuel for disinflationistas?

Morning from Europe!

Hopes and expectations are building ahead of the CPI reports from the two major anglo-saxon economies this week. Both reports will deliver material disinflation in YoY terms, which is typically what markets focus the most on, but the underlying MoM and QoQ trends will be much more important for central banks given the material base effects at play.

US consensus expectations look for 0.1% headline inflation and 0.3% core inflation month on month and both look slightly too “inflation hawkish” relative to our models.

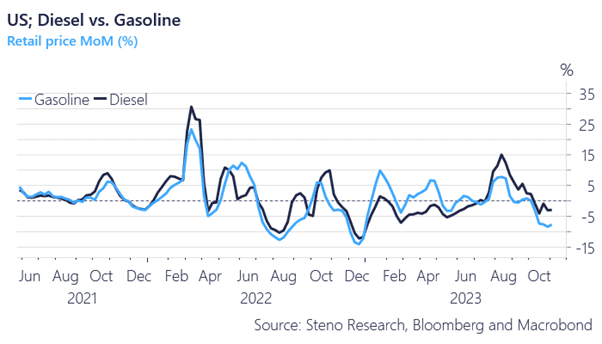

Energy will deliver material disinflation in the US, while also food prices have started to move down it seems. We will release our full preview later today but see risks skewed towards a soft reading. Various now-cast models rhyme with our view.

Chart 1: Material month on month disinflation in the US energy space

Market consensus clearly hoping for soft inflation prints from both the UK and the US this week. Will they get more fuel for the disinflationary rally?

0 Comments