Something for your Espresso: Food for hawks or doves?

The NFP report made for hawkish reading on the surface, but a few technicalities impacted the January report largely.

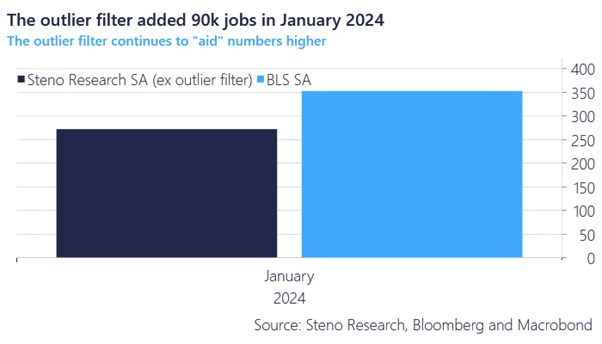

First, the seasonal adjustment continues to add a pre-pandemic amount of jobs in January, despite signs of fewer seasonal layoffs due to a less dynamic labour market around the festive season. On top of that, the outlier filter, which keeps removing January observations from 2021/2022/2023, added 90k jobs on a stand-alone basis.

The job creation is in other words much weaker than reported, when we adjust for the seasonal technicalities. On top of that, almost 2mn workers only work part time due to inclement weather in January and it is most likely a major reason why the “hours worked” component of the report dropped to new cycle lows.

As earnings are divided with the average hours worked, the average hourly earnings may have been helped artificially higher by this weather related drop in working hours.

The repricing on Friday in USD interest rates looks excessive given these observations and Powell didn’t change his tune much in the 60 minutes interview yesterday despite this “strong” labour market report.

Chart 1: The outlier filter keeps adding plenty of jobs in January

The NFP spooked rates markets, but there are reasons to believe that technicalities were behind the spike in job creation and wage growth. Time to receive again?

0 Comments