Something for your Espresso: Energy not yet a consensus bet, being short Europe is..

Morning from Europe.

We received the monthly fund manager survey yesterday and it seems like Energy remains an underweight relative to benchmarks despite the recent performance. The monthly OPEC report hints of an undersupply of 3mn barrels through Q4, which is based on slightly optimistic demand assumptions in our view. The market is though without a doubt tight and the trend remains your friend here.

Managers are also underweight both Europe and the UK relative to benchmark allocations, while they also expect the Chinese economy to weaken further. The change in sentiment around China is absolutely remarkable in the survey, from a big consensus long in Q1 to a big consensus “no-go” in Q3.

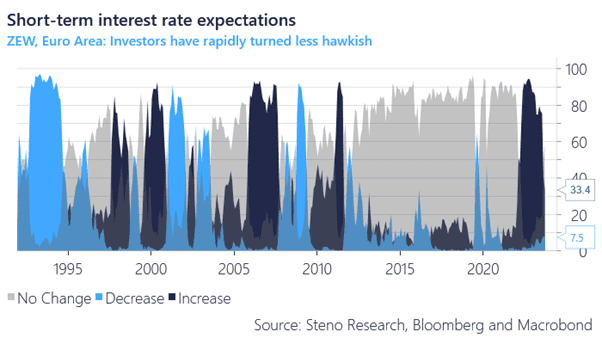

European consensus is getting crowded around the recession-narrative. Rates expectations have fallen off a cliff in the ZEW, meaning that investors are now betting on peak rates from the ECB around the corner. Is the long bond case getting crowded again?

Chart 1: Investors have swiftly changed tune on short-term EUR rates expectations

Energy keeps performing against all peers and it seems like positioning is still underweight despite the recent bullishness. European positioning is getting short, but data keeps backing up that view.

0 Comments