Something for your Espresso: Cognitive dissonance?

Morning from Europe.

Quite the gap opening in rates this morning as US Treasury markets wake up from the Columbus Day hiatus. The big test for the rates market is the CPI on Thursday and if this morning’s Norwegian CPI report is a harbinger, look for disinflationary vibes all over.

Norwegian inflation was through the floor this morning (-0.1% MoM) and 3.3% YoY. Core inflation running at 0.4% MoM still (CPI-ATE), so housing, water, electricity and gas category behind most of the weakness, but also food prices come down markedly

The FX effect is also noteworthy as the NOK has gained some territory (in momentum terms) leaving the inflationary effects from the imported prices less pronounced now.

I think there is some merit to the softening inflation view (outside of energy) in the US as well and this month’s report is not going to look particularly inflationary.

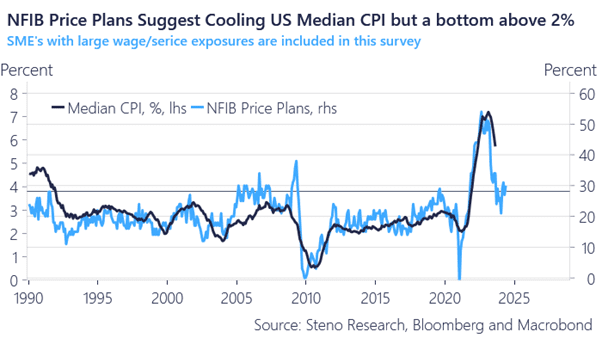

My main worry is that underlying US price developments will bottom well above 2% as hinted by the NFIB price plans. The NFIB price plan survey may hence be the most important forward looking inflation clue delivered this week. The survey is out 10am Eastern today.

Our full preview of the US CPI report is also out later today.

Chart 1: Prices to bottom well above 2% in the US?

We are walking a tightrope with war, high energy prices and recessionary risks. Is the market pricing congruent or does market pricing suffer from cognitive dissonance here?

0 Comments