Something for your Espresso: China adding to the cyclical momentum (against the USD)

Morning from Europe!

The tide is turning in the USD it seems. We had envisaged a sharp turn-around in the USD trends from early 2024 as the US would eventually catch down to the rest of the world in growth-terms, but a few positive glimpses out of China and continental Europe have now moved the needle in that direction faster than anticipated.

The Chinese monetary authorities added 80bn Yuan in liquidity and kept the loan prime rate unchanged, but markets salute the attempts to underpin the property sector again. We remain underwhelmed by the Chinese response, but also have to accept that the USD looks weak technically here. We were accordingly stopped out of USD/CNH carry longs this morning.

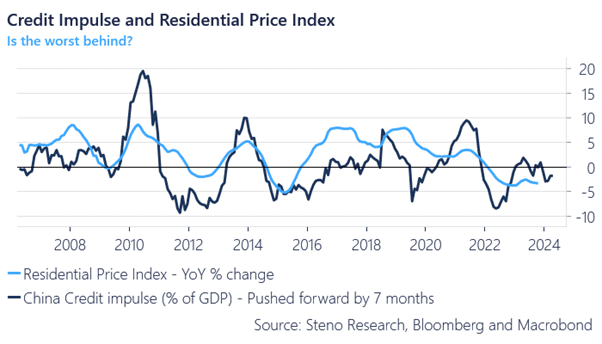

While the worst may be behind us in China, our forward-looking indicators remain lukewarm at best and we don’t see China refueling the global cycle in the way we have seen a couple of times since 2010.

Chart 1: A very underwhelming Chinese credit fuel

The USD continues to weaken from the morning after a Chinese liquidity injection. Cyclical tailwinds continue despite very dire forward-looking indicators on Western consumption into 2024.

0 Comments