Something for your Espresso: Central bank bonanza week with pause all over it

Morning from Europe.

The anticipated Spanish election ended in an inconclusive outcome. The conservative block did not gain a majority in Spain and PP/Vox will struggle to get the backing of regional parties.

This should prove to be a nothing burger for markets or even slightly positive as there is even a potential path for Sanchez to stay in office now if regional parties want to ensure that Vox (right-wing) is kept from office. The most likely scenario is another election later in the year, but we don’t buy the investment bank consensus that an inconclusive result is bad news for risk..

The Spanish election will not play a major role in the ECB policy decision this week and even if the 25bp hike has been pre-announced, we think that Christine Lagarde will kick the can down the road on the discussion on whether this is the final hike. Even the über-hawk Klaas Knot admitted that the ECB decision in September was not a given hike.

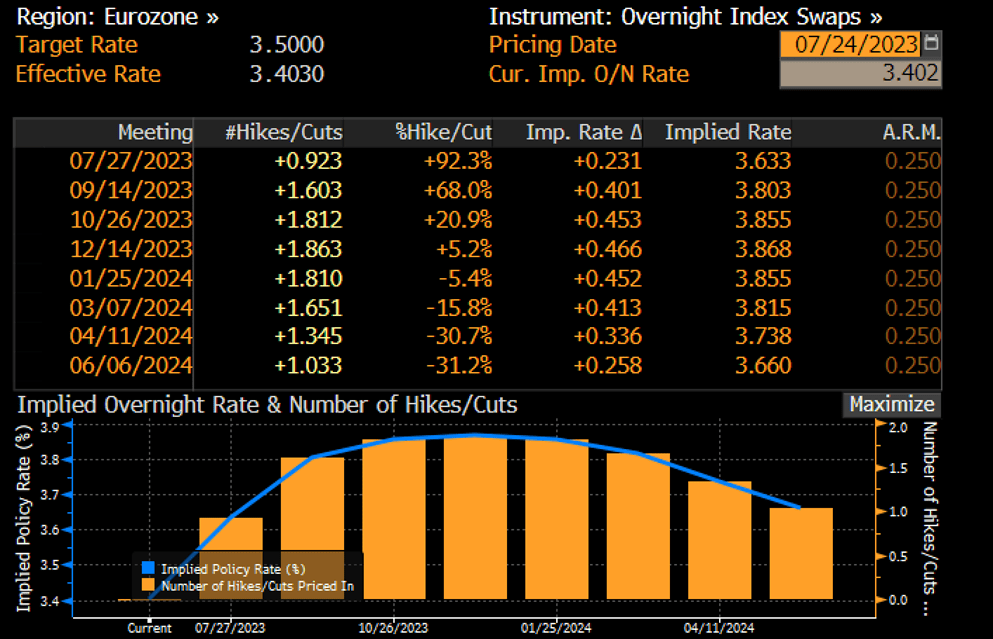

The ECB pricing leaves roughly 15bps “on the table” for September, which seems elevated to us as the ECB is likely to be surprised on the low side of projections on inflation ahead of that meeting.

Chart 1: ECB pricing

The big three central banks meet this week and we find a 25bp hike given for both the Fed and the ECB with limited forward guidance due to a lack of updated projections. It will prove to be an outright shocker if the BoJ moves the needle this week.

0 Comments