Something for your Espresso: A pause with a truckload of ifs

Good morning from Europe!

The RBA continued its pause even if the door was kept open for further tightening down the road, but the rhetoric is very uncommitted for now.

The rhetoric on inflation has increased confidence in continued disinflation – “Inflation in Australia is declining but is still too high at 6 percent. Goods price inflation has eased, but the prices of many services are rising briskly. Rent inflation is also elevated. The central forecast is for CPI inflation to continue to decline,”

And the only major if on inflation is in relation to trends seen elsewhere in Services. “Services price inflation has been surprisingly persistent overseas and the same could occur in Australia.”

This admittedly sounds like a central bank that hopes not to raise interest rates again unless truly forced to by sticky inflation. A tone that has been mirrored by other central banks with a large sensitivity to housing.

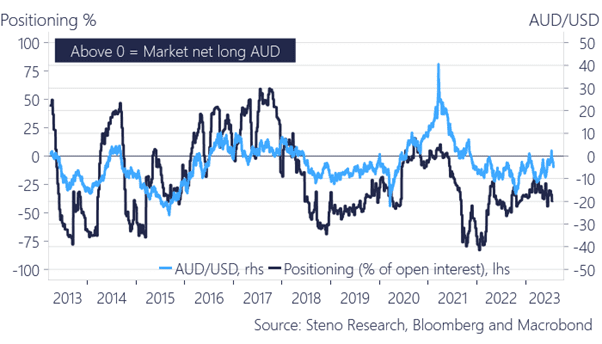

We took a beating in our AUD longs, but remain long in anticipation of tailwinds from the Chinese story. AUD is after all not a rates-spread currency, but rather a commodity/manufacturing cycle currency.

Chart 1: AUD positioning is still bearish, which should cushion the downside

The RBA kept the pause intact despite markets tilting towards a hike and it raises questions ahead of the BoE on Thursday. Is growth back as the driver of central banks? Meanwhile, credit surveys continue to disappoint.

0 Comments