Something for your Espresso: A deflation shocker from the UK?

Morning from Europe!

The final week of trading ahead of the holiday season with a few major macro events left.

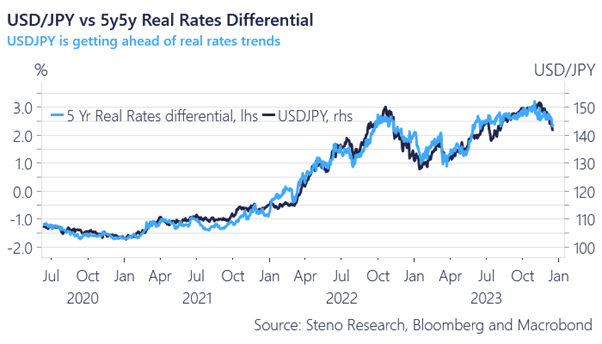

We see some consolidation in USDJPY ahead of the conclusion of the BoJ meeting tomorrow. Market expectations are very muted, and we reiterate that when the BoJ talks about a rate hike by “year-end” it refers to the fiscal year-end in April.

The other thing we know is that the BoJ is likely to leak the policy change ahead of the actual implementation, which is why the risk of policy action tomorrow is very low.

Forward pricing of the Fed in real terms remains the main driver of USDJPY for now, and quite a few of the FOMC lieutenants (Williams, Goolsbee) have been out trying to back-paddle after the violent market reaction post the presser on Wednesday.

Chart 1: USDJPY moving alongside real spreads

Will the UK inflation report surprise on the low side on Wednesday? Our models are very dovish compared to consensus. We also await the decision from the BoJ but find JPY to have entered a structural uptrend here.

0 Comments