Crypto Moves #5 – Betting on Macro

This edition of Crypto Moves is free. If you want to read future editions, either on our website or sent directly to your e-mail, then please sign up here. For a limited time, you get 20% off your first 3 payments by using the code ‘crypto20’, so you get our independent crypto research for $160 annually (excl. VAT & taxes).

We are laying all our cards on the table right away.

We are surprised by last week’s upward move in crypto, following our conviction in recent weeks of an overbought market in the near term.

After trading sideways for much of November, where we saw little interest, we were suddenly inundated by a significant inflow of liquidity and interest, particularly in Bitcoin.

This caught us off guard, especially as it occurred within such a short timeframe. We largely underestimated the recent optimism regarding an extremely favorable soft landing next year, where the market expects the Federal Reserve, alongside other central banks, to significantly reduce interest rates without causing a recession.

The recent upward move in Bitcoin appears to be quite healthy, as it suggests that it is more driven by spot buying rather than speculative futures.

We are primarily considering two scenarios for crypto from this point onward, both of which hinge on macro factors: either a soft landing or a hard landing. It seems that the crypto market is now more than ever influenced by macroeconomics. We will delve into the details later on how we would prepare for each scenario. However, you must ultimately form your own conviction on whether we will experience a soft or hard landing.

In short, we are still on a hard landing, so we exercise patience, as we have also done in recent weeks, but in hindsight, too early. On the contrary, if you are on a soft landing, this is your time to accumulate like crazy because then we are likely in for a significant bull run in the next one or two years. It is no secret that these bull markets have been accompanied by significant returns. We expect this to be no different if we indeed enter a soft landing, and especially Ethereum is on our radar.

But first, let us examine the upward move of the past week.

Bitcoin leads the market, the rest attempts to catch up

The recent upward movement in the past week was predominantly fueled by Bitcoin, with other assets making efforts to catch up, potentially influenced by a combination of macro optimism and the anticipation of the imminent Bitcoin spot ETF.

Although the second-largest crypto, Ethereum, experienced some positive momentum, it notably failed to match the rapid pace set by Bitcoin. This is unexpected considering Ethereum’s historical tendency to outperform Bitcoin during periods of risk-on sentiment and the market’s broad expectation that Ethereum will have its own spot ETF shortly after Bitcoin’s.

Chart 1: The Price of Bitcoin and Ethereum in the past month

Despite being the standout performer in recent months, Solana displayed relatively sideways movement in the past week, following a substantial rally of 200% since mid-October. The sideways trading of Solana can be attributed, perhaps, to profit-taking and traders rotating to Bitcoin. Still, it is noteworthy that Solana could not match the upward momentum of Bitcoin, especially considering its ability to experience price movements with a comparatively much smaller inflow. This underscores our view that Bitcoin has been the paramount force in crypto in recent months and especially in recent weeks.

Chart 2: The Price of Solana

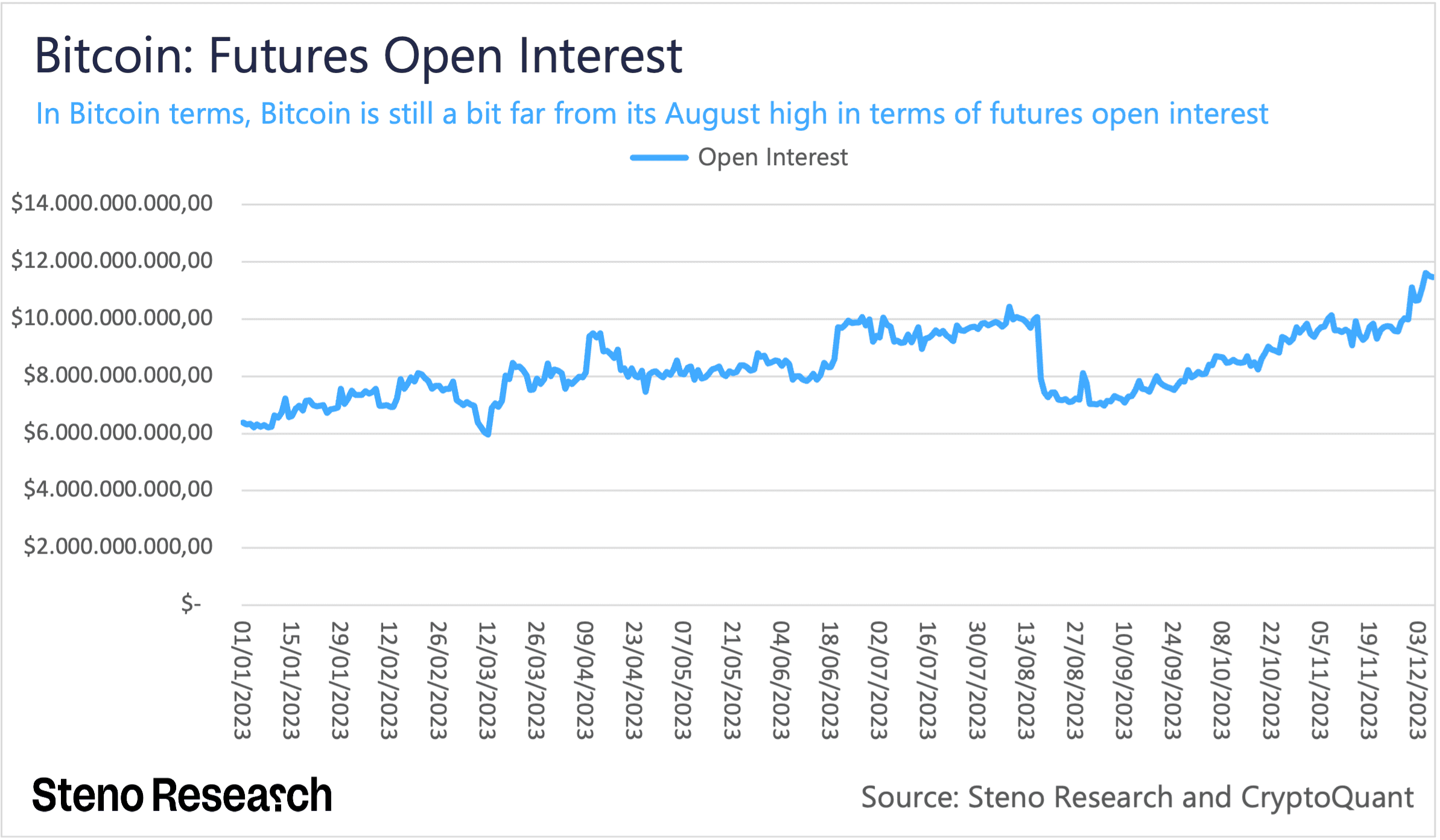

The open interest in Bitcoin futures increased in USD terms over the past week, as anticipated. However, when measured in BTC terms, it has not yet reached its August levels when interest in Bitcoin and ETF excitement was significantly lower. Furthermore, the funding rates for Bitcoin perpetual futures are currently in a notably positive range, signaling the possibility of overleveraging and a crowded long market. Nevertheless, these rates are far from the highs observed in 2021 and 2022. This implies that the recent upward movement is relatively organic and carries less leverage than usual, suggesting a more spot-driven influence rather than being predominantly fueled by derivatives.

Chart 3: Open Interest of Bitcoin Futures

Chart 4: Funding Rates of Bitcoin Perpetual Futures

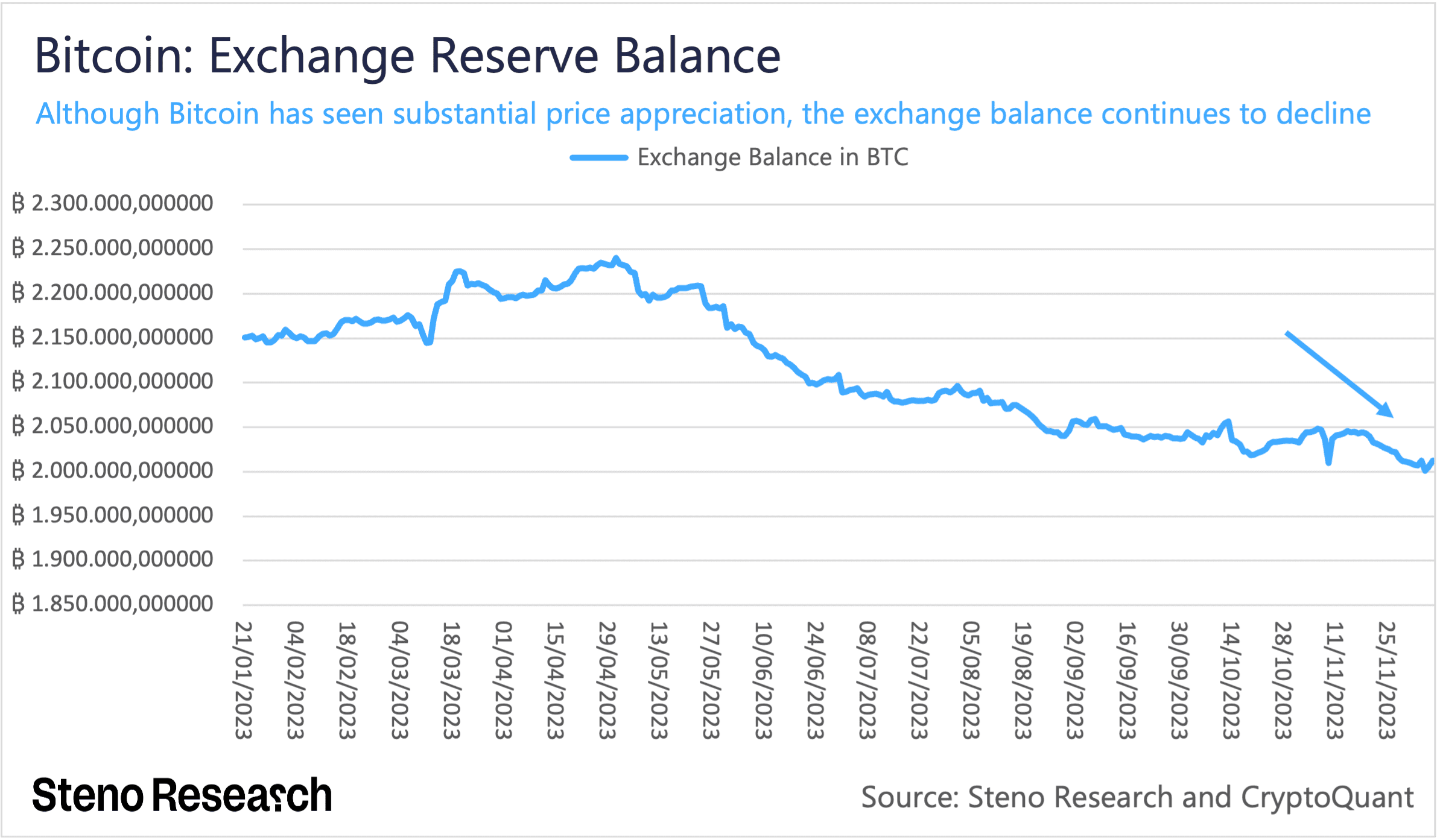

The decreasing exchange reserve balance of Bitcoin underscores that the current surge is propelled more by spot purchases and long-term holding rather than short-term trading. The declining balance over the past month suggests a trend where investors are opting to retain their Bitcoin holdings instead of selling.

Chart 5: Bitcoin Exchange Reserve Balance in the past months

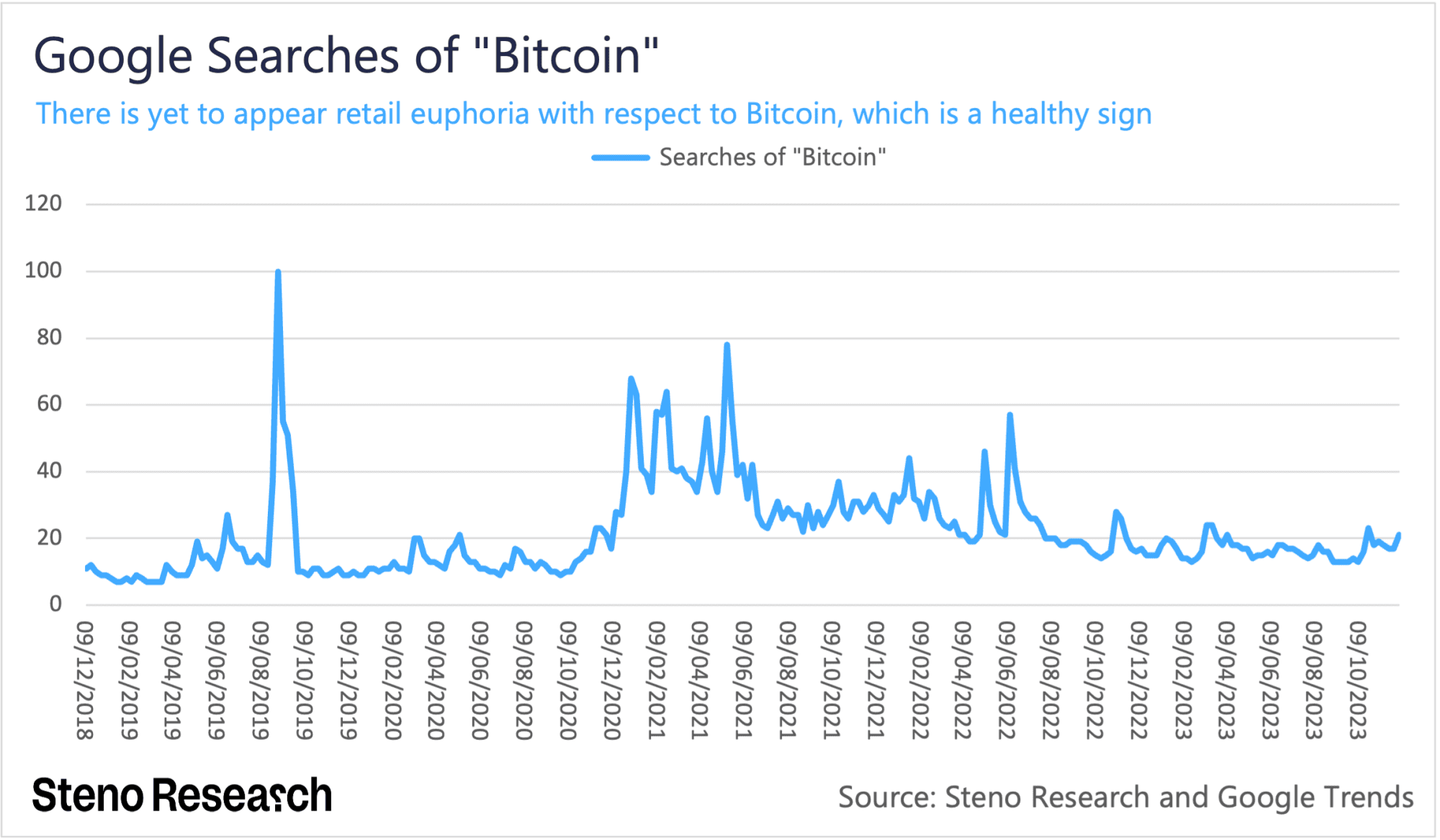

Historically, speculative retail activity has significantly influenced the crypto market compared to institutional participation. An easily quantifiable indicator of this speculative interest is Google searches, which, in recent months, have shown minimal increase. This observation leads us to believe that the recent week’s price appreciation may be driven more by institutional investors rather than speculative retail activity.

Chart 6: Google Searches on “Bitcoin”

In summary, we interpret the recent upward movement in the past week as notably healthy and organic. This inclination suggests a higher likelihood of sustainable market dynamics.

The macro conditions decide our path from here

While we perceive the recent uptrend as natural, the future trajectory is contingent on the prevailing macro environment. The crypto market, being highly responsive to monetary policy, places significant importance on the decisions and actions of central banks, as well as other macroeconomic variables, in shaping its course. Presently, both the crypto market and equities have factored in an almost perfect soft landing for the upcoming year, anticipating substantial interest rate reductions from central banks globally.

In this scenario, there is minimal tolerance for any deviations from the anticipated macro conditions. Unexpectedly continued tightening of monetary policy, fewer-than-expected rate cuts, or a shift towards a hard landing could trigger a sharp correction in the crypto market.

With that in mind, let us first analyze the development of the crypto market if the macro environment aligns precisely with the market’s expectations for the coming year.

In this scenario, we anticipate the onset of a new bull market from the next year onward.

This projection aligns with the historical 4-year cycle of the crypto market, influenced by the Bitcoin halving in April 2024, as discussed in Crypto Moves #2, and various other encouraging factors. These factors include a continuous rise in institutional adoption, regulatory clarity, and notably, the imminent Bitcoin spot ETF. Regarding the latter, our stance remains consistent with the analysis presented in Crypto Moves #3, acknowledging the potential short-term selling pressure induced by the conversion of the Grayscale Bitcoin Trust into an ETF. Nonetheless, as emphasized before, we perceive the long-term impact of the ETF as overwhelmingly positive. If you are on team soft landing, then we see no issues accumulating at these levels, but please prepare for rather significant corrections along the way.

That being said, in this potential soft landing scenario, we observe more significant risk/reward dynamics in crypto compared to Bitcoin, particularly in the case of Ethereum, which we deem notably undervalued relative to Bitcoin at current price levels. Several factors substantiate this perspective.

Ethereum has demonstrated substantial outperformance relative to Bitcoin in the past two bull markets, primarily attributed to its speculative on-chain activity. We anticipate a similar increase of such activity in a potential upcoming bull market. Additionally, while Bitcoin has witnessed heightened ETF enthusiasm, Ethereum has experienced comparatively less, although the anticipation is that an Ethereum ETF will eventually follow in the footsteps of Bitcoin. We anticipate that this enthusiasm will eventually be reflected in the price of Ethereum.

Notably, any potential bull run from now on marks a unique situation for Ethereum as it has largely transitioned to a deflationary model following the Ethereum merge on September 15, 2022. The merge shifted Ethereum’s consensus mechanism from Proof of Work to Proof of Stake, significantly reducing its issuance rate from 4% to less than 1%. Previously, miners were rewarded with approximately 5.4 million Ether annually, a substantial portion of which was promptly sold, contributing to significant selling pressure, arguably exceeding $10 billion in 2021 alone.

Post-merge, stakers are now rewarded with around 870,000 Ether annually, and only a minority of this is typically sold, given that stakers are generally long-term holders with minimal staking-related expenses. Consequently, Ethereum has experienced an unprecedented reduction in its supply by slightly over 300,000 Ether out of its approximate 120.2 million circulating supply, as more Ether has been burned due to transaction fees than issued. This reduction is poised to have a significant and unparalleled effect during a bull market.

Chart 7: The Ethereum Circulating Supply

In this scenario, we find it plausible that Ethereum could reach as high as 0.1 ETH/BTC, contrasting with its current level of approximately 0.054 ETH/BTC. This suggests a potential nearly doubling in price appreciation relative to Bitcoin. $10,000/ETH is not off the table in such a cycle. According to our view, the market is simply positioned on the wrong foot, considering a soft landing.

The event of a hard landing

The aforementioned outlook acknowledges the limited scope for unforeseen developments in the macro environment. Our anticipation leans towards a hard landing rather than a soft one, supported by numerous indicators signaling a potential recession, with the credit impulse being a prominent factor, as illustrated in Chart 8.

Chart 8: The Credit Impulse

The million-dollar question is then: How will the crypto market react to a hard landing?

Except for a brief technical recession during the pandemic, this would be crypto’s first.

Given crypto’s inherently speculative nature and its high sensitivity to market sentiments like fear and greed, a recession is likely to trigger a significant sell-off and price correction in the market, particularly at these price levels. While we anticipate Bitcoin to outperform the broader crypto market in such a scenario, we still envision a decline in fiat terms.

Addressing the apparently now common perception that Bitcoin serves as a hedge against recessions, it is crucial to exercise caution, as historical narratives can shift unexpectedly. In 2021, Bitcoin was widely regarded as an inflation hedge until circumstances proved otherwise.

During a recession, the conventional response from central banks involves slashing interest rates and injecting money and liquidity into the economy. While such measures have traditionally been positive for crypto assets, the unique characteristic of fear in the crypto space during a recession raises concerns. In this context, the impact of fear on the crypto market is anticipated to be more pronounced than the positive effects of increased liquidity, which tends to lag behind.

In essence, our market view suggests that a recession induces fear, leading to a downturn in the crypto market until the infusion of liquidity propels a recovery. However, it is essential to note that the start of a potential recession is uncertain, spanning from two months to a year or even more. During this period, close monitoring of inflation numbers, economic activity, and potential interest rate adjustments by central banks becomes paramount. This also means that we can continue seeing substantial price appreciation before a potential recession hits.

While this represents our current market perspective, the landscape remains riddled with uncertainties, emphasizing the need for vigilance and adaptability in navigating the evolving economic climate. Until that, you need to choose which team you are on soft – or hard landing.

0 Comments