Crypto Moves #3 – The ETF Opens the Floodgates for the Long Term

If you’re familiar with the context or lack the time to go through quite a few pages, feel free to jump to the conclusion found in the subsection titled “Short-term selling pressure, long-term potential.”

The twins from the movie, The Social Network, Cameron, and Tyler Winklevoss, filed for an application for a Bitcoin spot ETF in 2013. This was the beginning of an infinite series of rejections by the Securities and Exchange Commission (SEC) in the US. Since then, the SEC has worn down its “REJECTION”-stamp by so many rejections of ETFs that even I have recorded fewer rejections from the opposite sex in the same period. The latter is quite an achievement, to be quite frank.

In 2021, the SEC granted a relatively sudden approval for Bitcoin futures ETFs, rather than a Bitcoin spot ETF. Unlike the latter, which is backed by actual bitcoins, the futures ETFs are structured around futures provided by the CME Group. The first of these ETFs saw its trading debut in mid-October 2021, about one month before the present all-time high of Bitcoin. In retrospect, this was a dream scenario for such ETFs, as it allowed the funds to tap into much publicity and liquidity amidst a massive bull run.

The most traded of these ETFs is offered by the firm ProShares. The latter set the record for the fastest any ETF has reached $1bn in assets under management. This was accomplished in just two days, beating the previous record holder, namely the SPDR® Gold Shares ETF (GLD) from 2004, by one day. Interestingly, particularly gold ETFs are of interest in the context of Bitcoin spot ETFs, as they may provide insight into the implications of Bitcoin spot ETFs.

ETFs have made gold mainstream

The initial gold ETF was introduced by ETF Securities in March 2003 on the Australian Securities Exchange. The following year, in November 2004, State Street launched the first gold ETF on a US exchange, specifically the previously mentioned SPDR® Gold Shares ETF. This particular ETF not only achieved $1bn in assets under management at an impressive speed, trailing behind only Bitcoin futures ETFs but it also holds one of the highest amounts of assets under management among all other existing ETFs with an approximately $55bn AUM. BlackRock’s iShares gold ETF is slightly lower on the list with nearly $26bn worth of managed gold holdings.

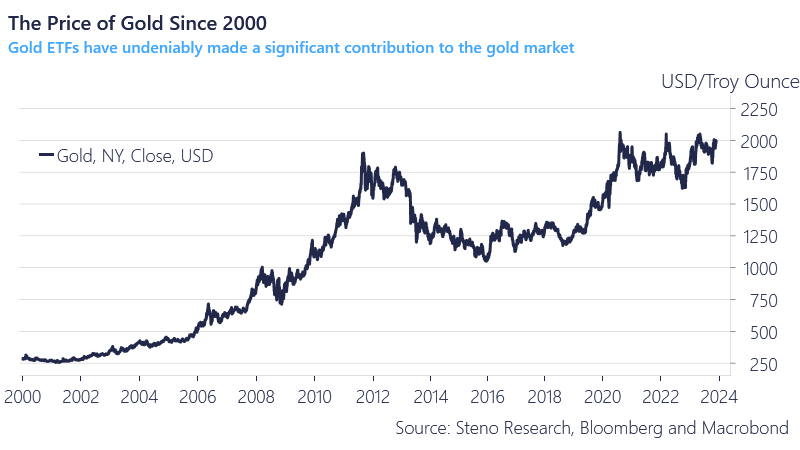

Gold ETFs have undeniably made a significant contribution to the gold market. Since their introduction in 2003, the price of gold has experienced substantial growth.

Chart 1: The Price of Gold Since 2000

We align with the market consensus that the approval of a Bitcoin spot ETF in the US is imminent. Given this widespread belief, we contend that this ETF might already be priced in, particularly considering the risk of Grayscale releasing billions of dollars’ worth of bitcoins into the market. Our assessment leans towards anticipating more downward selling pressure than the opposite, contrasting with the prevailing market sentiment.

0 Comments