EM by EM #4 – Argentina and the real de-dollarisation

While Yellen finds it increasingly difficult to internalize her frustration with the Republicans in the US Congress over the debt-ceiling circus, the Argentines suffer from the exact opposite problem- In contrast to the US political deadlock, Argentina’s inability to access international credit markets is due to a lack of political appetite for painful austerity measures alike the ones the GOP dreams of enforcing

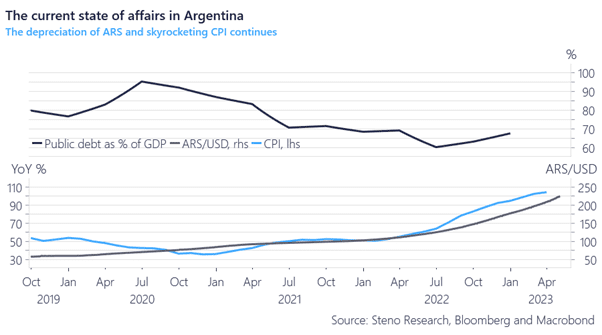

The Argentine debt deadlock is of course not a new phenomenon, but a recurring issue that arises periodically as the economic cycle impacts public finances. The inability of the political class to implement necessary reforms leads to crises with the same root cause: Irresponsible fiscal policies fueled by debt. In difficult times, servicing the debt becomes challenging, leading to recurring crises.

As MMT’ers (correctly) would repeat till your ears ring- as long as the debt train runs on your domestic sovereign currency, default cannot be enforced externally. True, but it is also the case for debt denominated in foreign currencies, as long as the local currency can be exchanged at scale and there is political backing for doing so. How does such a debt trap look in practice? Don’t do this at home:

Chart 1: ARS/USD vs CPI and Public Debt

In recent weeks, social media and leading financial media have been flooded with sensational articles about the dollar’s demise. In this piece, I will provide an analysis of the actual immediate obstacles facing the American dollar where USD hegemony is being undermined. Given the current US debt ceiling theater, one can scarcely think of a better point of reference than the debt default champion of the Western hemisphere: Argentina

0 Comments