5 Things We Watch – Fed, BoE, Energy, GDI/GDP & BoJ

1) Is the Fed done hiking?

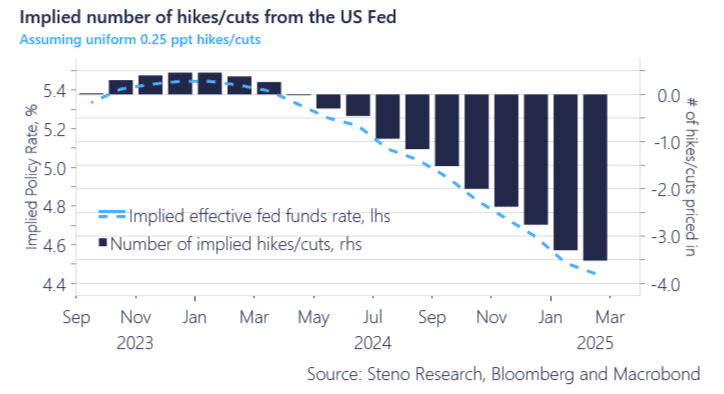

First it was a pause, then we got a hike and now it looks like we are back at pause with the market having priced in another 11 bps coming at the end of the year. Currently, the Fed is priced to commence its cutting cycle by H1-2023 slightly ahead of the ECB and we have for some time now highlighted that we do not believe that the Fed will lead this cutting cycle hence our USD bullishness. The reasons are:

- Growth: Both Services and Manufacturing have clearly surprised the UPSIDE since the June meeting and all sell-side economists have been busy revising up growth forecasts. The Fed will do the same.

- Inflation: Inflation was moderating along expectations until Bin Salman decided to wreak havoc with energy markets, while the super-core momentum worsened materially in the so-called Powell-flation metric in August. Nothing points to a benign surprise for the FOMC relative to the expectations in June, rather the contrary. Inflation also speaks in favor of a hawkish dot plot.

For these two reasons we have dubbed the US the name we have dubbed it ‘The cleanest dirtiest shirt’.

Chart 1: 25 bps priced for the rest of the year

With Central Bank rate decisions taking headlines this week, we have a look at the 5 things we watch in global macro, and give you our take on FOMC, BoE and more.

0 Comments