5 Things That Could Wrongfoot Consensus in 2024

The overwhelming consensus for 2024 continues to be a soft landing in the US with interest rates coming firmly down while growth continues on autopilot, which leaves a very decent, almost goldilocksy, outlook for risk assets.

But what if we don’t end in a soft landing, but rather one of the tail-end scenarios of either 1) a boom driven by easier financial conditions, which would force the Fed to push back a bit on rate cuts or 2) a recession, which would imply rates much lower than what consensus currently is.

We have chosen 5 “likely unlikely” scenarios for 2024, which are not as unlikely as current market pricing indicates.

Our “likely unlikely”-scenarios for 2024 are:

- The boom in activity AND prices

- The downfall of CRE

- Fed cuts leave BoJ muted

- A balance sheet recession due to tighter credit standards

- The return of supply chain tightness

Likely unlikely #1: The disinflation trend proves to be short-lived

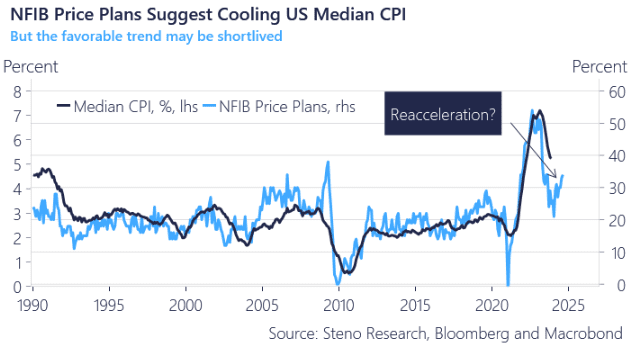

The main risks connected with a soft landing remains the probable event of re-accelerating inflation. It almost looks like the market consensus implies that markets believe that inflation was solely supply-driven and that getting inflation back to 2% has everything to do with supply, and nothing to do with demand.

If the growth picture turns out in favor of current consensus, it will likely be accompanied by re-accelerating inflation in Q2-2024, which will likely not be a cocktail that risk-assets enjoy. The USD typically predicts the direction of the economy by roughly 6 months, and given the recent USD weakness, there are arguments as to why we could see a boom in PMIs next year – but likely not an environment that equities thrive in, if this boom is accompanied by rising prices again.

The supply side is still constrained, why an early boom in the demand side is likely to lead to another inflationary wave.

Chart 1.a: Higher growth but higher inflation?

We round off 2023 with some what-ifs that could wrongfoot consensus in 2024. And maybe they are not as unlikely as current market pricing indicates.

0 Comments