USD CPI Watch: The tricky path to 2% despite a soft report

Another CPI report, another preparation piece, where we as always share our thoughts on the coming report, what to expect next, and how far the Fed is from their all-important mandate of 2% inflation.

Main conclusions/notes upfront:

1) The path to 2% is tricky or almost impossible for the next 6 months. CPI needs to average 0% MoM, which does not seem feasible.

…

8) Still a large risk of Fed December hike

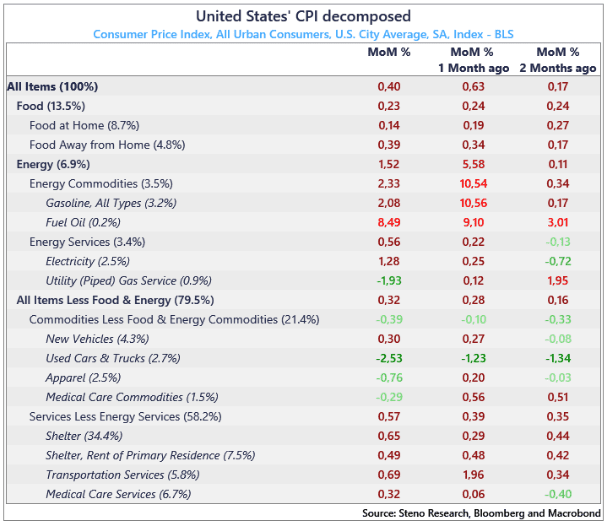

Last month’s print came in hot at 0.4% MoM with energy prices still pushing the monthly rate higher despite positive disinflation signs from food, used cars and transportation services, which previously have been some of the main drivers of overall inflation levels.

The shelter component is likely to remain elevated due to its unbelievably lagging characteristics, but even if you remove the component, the so-called Powell-flation is on the rise again, which is not a good sign for doves, as this makes the path to 2% even more tricky than what base-effects has already made it.

A full overview of the MoM rates over the past 2 months is attached below:

Chart 1: US CPI decomposed

The US CPI report will land in our inbox tomorrow, and while tomorrow’s print could look promising for the disinflation-crowd, the path toward 2% is more tricky than first anticipated.

0 Comments