USD CPI Review – A slightly hawkish surprise

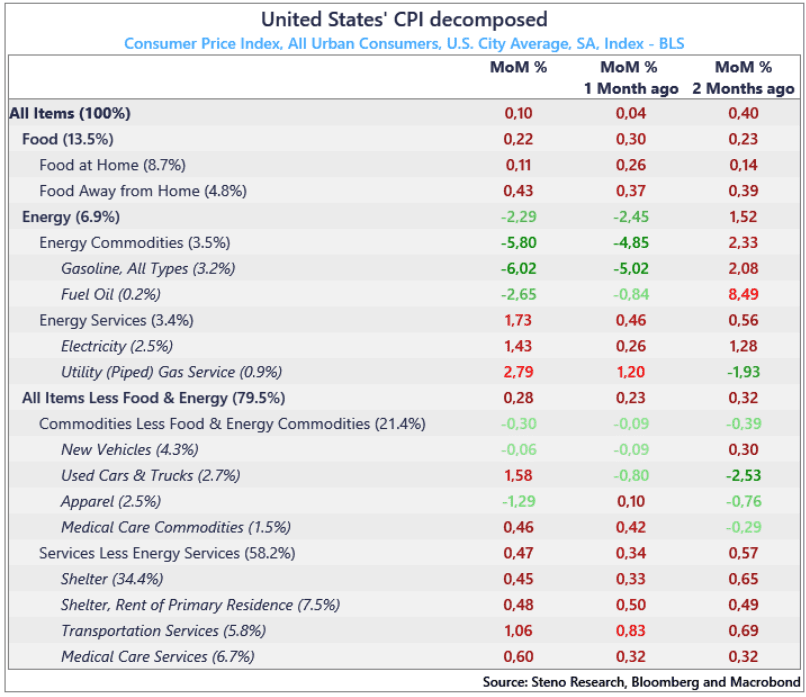

US headline CPI rose 0.1% MoM vs 0.0% expected while the YoY figure and core numbers were in line with expectations in rounded figures (even if both printed above market consensus on an index level), but after an initial dovish move on the release, it seems like markets slowly but surely absorbing it as the hawkish surprise that it ultimately is.

We had three out of four major calls/components in our now/forecast correct

Used cars were up 1.28% on the month in line with our prediction, transportation services were up >1% as we highlighted and Medical Care Services were up 0.6% on the month. We were admittedly completely off on apparel dropping 1.3%-points, which is extremely off compared to our online observations.

This leaves an interesting December ahead, where we could see a strong reversal in apparel if our online indicators are to be trusted. Other nowcasts support our data of rising apparel costs into the year-end.

Energy commodities continued to drop on the back of falling Natural Gas and Oil prices, while Energy services came in hot compared to October. Markets really need deflationary impulses from energy to continue from here if current pricing should be justified, as forward-looking price indicators are starting to turn inflationary again.

Chart 1: US CPI Decomposed

Read the main takeaways from today’s CPI report here, which came in slightly above expectations. The details of the report are hawkish, but as per usual inflation data is up for interpretation. We stick to long USD and paid front-end USD rates here.

0 Comments