US Equity Watch: A rotations game

No rest for the wicked, when it comes to macro. On Friday, First Republic Bank was seized by the Federal Deposit Insurance Corporation – the FDIC – and now, JP Morgan has bought all of the troubled San Francisco-based banks’ deposits and most of its assets from the aforementioned authority. At the time of writing- PacWest seems in trouble.

Besides a stressed banking system (on the brink, some would argue), the economy is indeed showing signs of weakness. That’s evident on several parameters. Diminishing excess personal savings, a weakening labor market, increasing non-performing loans, climbing delinquencies, and ghost-like office areas, to name some of the most prominent challenges the economy is facing. Throw on top of that an expected x-date on the debt ceiling, and you’ve got something echoing a perfect storm.

But, what does the market have to say about it all? In this edition of the Watch Series, we’ll zoom in on the US equity market, and try to highlight pitfalls and possible (if any) windows of opportunity.

Time to turn defensive, or simply leave the table?

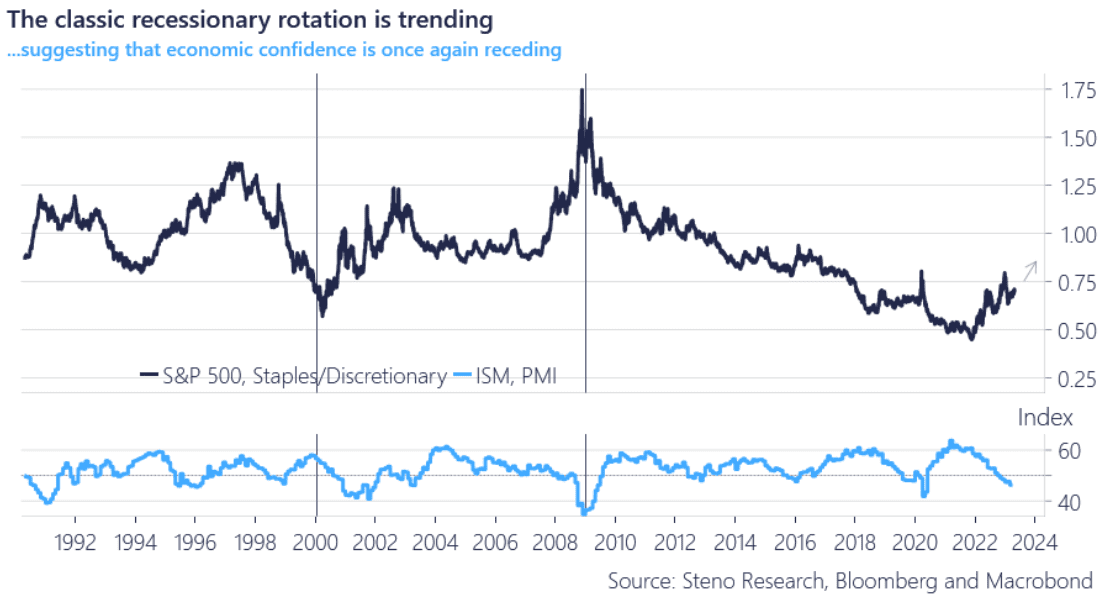

Looking at the classic rotation from discretionaries towards staples in the broad S&P 500 index, it sure looks like investors have begun rotating their portfolio, hiding in less sensitive and shorter duration bets in order to safeguard against what could be a choppy second half of the year.

Staples are less sensitive to a decline in economic activity as well as tighter credit standards and deferred ebbing liquidity, relative to discretionaries. In that sense, the reallocation towards such defensives makes sense, but the question is, whether that narrative is already fairly exhausted and the upside thus likewise – something we’ll look closer at later in the article.

Chart 1: Investors bracing for headwind

Areas of the economy are showing increasingly worrying tendencies, and some are outright caving in. Ahead of today’s FOMC meeting, we decided to take a closer look at the state of US equities and whether the defensive rotation was due – or if one were better off leaving the table entirely…

0 Comments