US Debt Watch: Who’ll absorb the blow?

A debt ceiling agreement has been reached, and, while we were never really in doubt, the US didn’t default and it can now continue to issue debt to service its obligations and finance its spending – until January 2025 for the time being. Many acclaimed experts have expressed their takes on the market implications of the TGA having to be replenished, and especially the impact on liquidity.

In this ‘US Debt Watch’ we take a closer look at the recommended Treasury financing and give our two cents on what to expect in regards to market reactions.

Indications given on the coming issuances

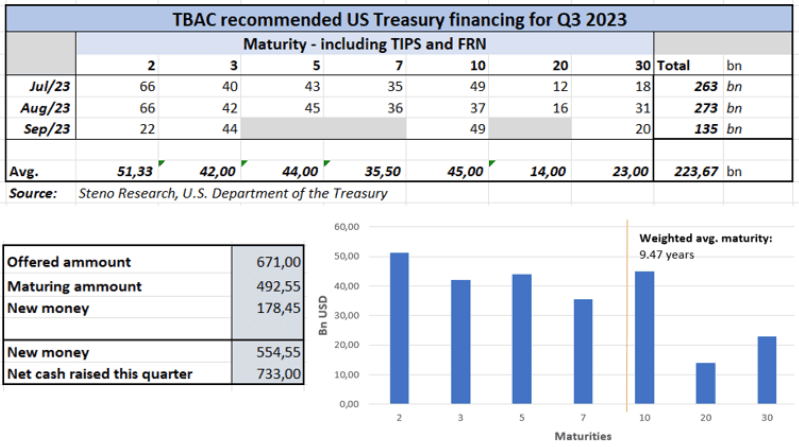

The Treasury Borrowing Advisory Committee (TBAC) published its recommended financing schedule for Q3-23 on May 3rd. Leading up to the agreement on the statutory debt limit, investor demand for 1m treasury bills was lacking, which meant that primary dealers had to absorb nearly half the recent issuance. Furthermore, treasury markets reflected signs of stress with investors demanding a nearly 120 bps premium for bills maturing in early June relative to those of the end of May.

The agreement was met just in due time, as the TGA was running on fumes, and now it has to be replenished. This entails a wave of issuance, which has to be absorbed in the market. All else equal, we expect that this will lead to asset managers showing a relatively preservative risk appetite, as they will have to swallow the duration risk and reallocate accordingly. In this equation, duration (time until maturity) is key, as the far end of the curve is way more sensitive to rate changes and hence more volatile and risky.

Not differing on TIPS and FRS relative to standard, the recommended issuance presents a weighted average maturity of 9.47 years, which is almost two years further out than seen since Nov/21 and through 2022 and 2023 so far – not super risk positive.

Chart 1: Recommended US treasury financing Q3 2023

An agreement on lifting the statutory debt ceiling has been made, and the treasury general account now has to be replenished by issuing new debt. What does that imply for financial markets, and is the outlook as bleak as some pundits claim?

0 Comments