UK CPI Watch: Softer than priced in..

Welcome to our UK CPI preview. We find the market consensus overly hawkish ahead of the release tomorrow and especially see softness in Services and Food relative to the market pricing.

Numbers in short:

Headline CPI -> Market consensus: 0.7% MoM .. Steno Research: 0.5% MoM

Services CPI -> Market consensus 0.5% MoM .. Steno Research 0.4% MoM

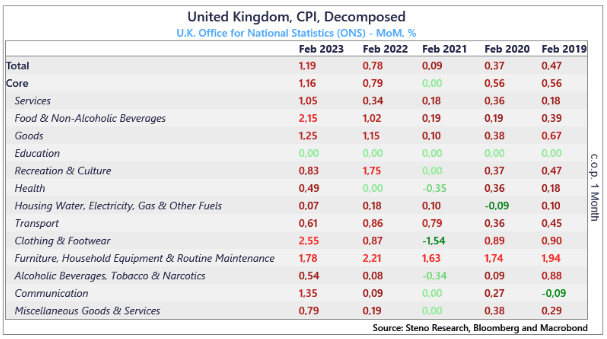

February is typically not an overly seasonally hot month for inflation, but in 2022 and 2023, February inflation printed at worrisome levels MoM.

The February 2023 report was driven by extreme price increases in 1) Food and non-alcoholic beverages, 2) Clothing and Footwear, 3) Communication, 4) Overall goods and 5) Services. In other words, it was a broad-based stinker.

The market consensus of an 0.7% MoM increase would be HOT in seasonally adjusted terms considering a slightly longer historical timeframe, and we see downside potential in a few but important categories based on our now-cast observations and lead/lag studies between producer- and consumer prices.

Chart 1: February inflation heatmap

We see UK CPI coming in soft relative to expectations and generally find the BoE to be priced too hawkishly compared to peers. Read along why here..

0 Comments