UK CPI Watch: No path to 2% unless inflation deflates on a monthly basis

Welcome to our short and chart-packed preview of UK inflation out tomorrow morning.

As per usual, we deliver the conclusions up front:

1) Extreme base effects are at play in October due to energy price revisions in October 2022

…

The monthly wage numbers from the UK serve as a reminder that an increase in the average weekly earnings in the UK could be seen as a sign of weakness. If low-skilled workers are laid off first, the sample will change in favor of jobs with higher wage growth, which is why an increase in wages is not necessarily a sign of strength.

Claims are still rising on a trend basis and there are signs of weakening labor market trends all over in the UK. We find it likely that a soft inflation report tomorrow will solidify that view and we will show why via a load of charts below.

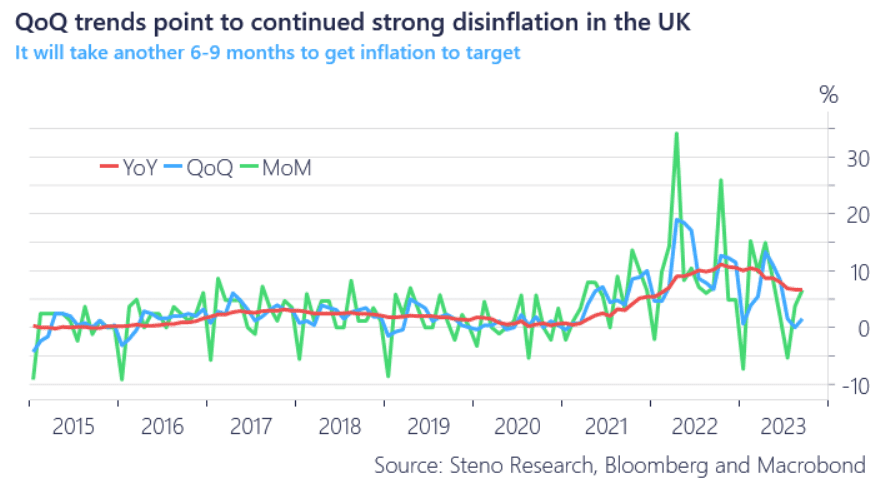

The CPI ran at 6.7% YoY (0.5% MoM) in September and expectations for October rest at 4.7% YoY (0.1% MoM). We see a clear downside to the consensus with a print of below 0% in the MoM figure.

Chart 1: UK annualized disinflation is clear in quarterly trends but 2% is still some room away

The UK CPI report will be put under scrutiny tomorrow morning after “hot” wage numbers released earlier today. The report is likely going to look very soft, but there is still a long way to go until 2% is reached.

0 Comments