UK CPI Watch – A deflationary shock?

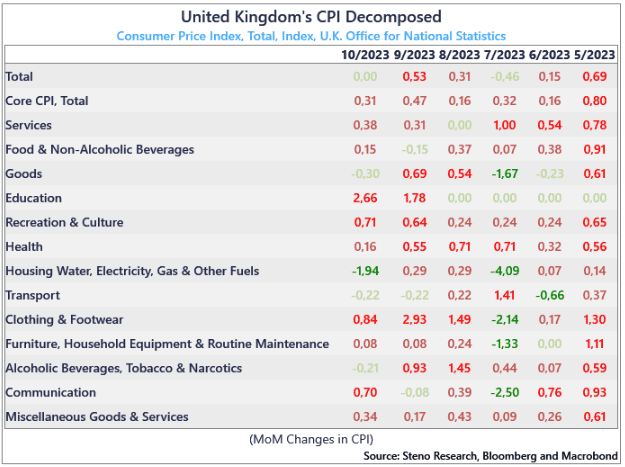

We recently entered a long UK duration trade in anticipation of further disinflation in the UK, which so far has been a winning trade as the recent payroll data and waning price pressures has been in our favor.

European economies are generally not who you should cheer for in this stage of the cycle, and the UK is no exception, with retail sales still worsening and employment payrolls now in negative territory, which makes current expectations for November’s print look strange, given the expectation of 0.1% MoM vs 0.0% in October.

Our forward-looking indicators and historical seasonality patterns suggest a print fairly below the consensus figure, with clear downside risks in services inflation, ‘Clothing & Footwear’ and ‘Recreation & Culture’ as a result of Black Friday price effects (which based on our limited web scraping looks to be larger than in the rest of Europe) and the recent weakness in payrolls, despite Black Friday disappointing compared to previous years as consumer demand looks awful in the UK at current junctures.

Chart 1: UK CPI decomposed

Markets are expecting a re-acceleration in November’s inflation number tomorrow with expectations at 0.1% vs 0.0% in October. What do our models tell us, and what should we expect? Our thoughts and findings here.

0 Comments