The Energy Cable #30 – Progress for The Bulls

Steno Research – Remaining long energy/commodities

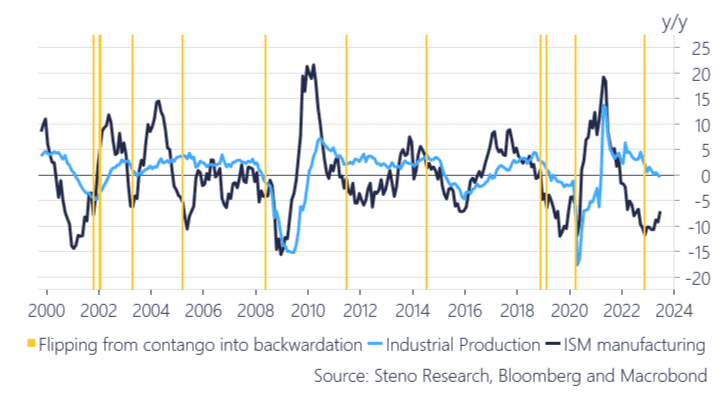

Last week at Steno Research we looked at the potential for a bounce in Manufacturing PMI numbers and we thought it would be natural to look at both hard and soft data through the lens of one of the most important signals in the energy markets, namely the flip from contango to backwardation. In general it can be said that the flip brings more volatility to soft data than hard data. Given PMIs general tendency to converge with hard data and its current levels (Almost GFC bearishness) we feel like there are plenty of reasons for betting on higher Manufacturing PMI numbers.

What happens to soft and hard data when the futures curve flips?

A weaker USD, a slight rebound in the Manufacturing cycle and still tight supply has re-ignited the energy space alongside the broader commodity trend. There is certainly progress for bulls now.

0 Comments