Services Nugget: How do the Central Banks react?

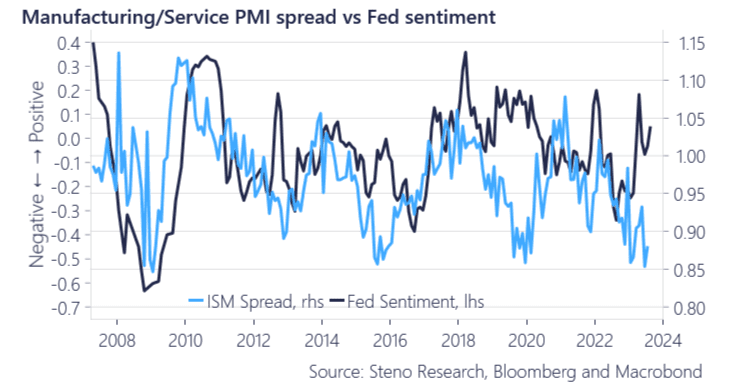

We have built a sentiment tracker that uses FOMC minutes and speeches of Fed members as data and assigns positive and negative scores to adjectives in order to gauge what the Fed’s sentiment on the economy is. We urge you to check out the Central Bank Sentiment Tracker. If we compare the Fed sentiment tracker with the ISM Manufacturing/Services ratio we note an interesting divergence in the two sentiments.

Either the Fed is too positive or purchasing managers are too negative – And before you conclude that businesses always know better than the suits at the Fed, let’s just recall the yuuuge divergence between soft and hard data from last fall. Given our general inclination towards manufacturing outpacing services we lean towards the camp that the Fed may be right about the current economy.

Plenty of arguments against the Fed being too optimistic outside the realm of ISM numbers though. USD wrecking ball, signs of labor market weakness and then of course oil prices.

Chart 1: Fed sentiment and PMI surveys diverging – Who is right on the economy?

We are well under way in our Services Week with our focus on Services and in this note we wanted to highlight the issues central banks could face in a scenario in which manufacturing outpaces services.

0 Comments