Positioning Watch – Turning our attention to Institutions and Fund Flows

Happy Saturday everyone, and welcome back to our weekly Positioning Watch where we take you through CFTC’s weekly positioning data to dissect how traders are positioning themselves, and what that might mean for assets in the time to come. We have switched up today’s format a bit, and looked solely at institutional positioning and fund flows to try and see what might be driving the price action we’re seeing at the moment.

Markets are still riding strong on the debt ceiling deal and the strong job market numbers from last week, while they await the CPI report and the following Fed meeting next week. And with expectations of a slightly dovish Jerome Powell, we believe markets could be caught on the wrong side. The RBA and BoC both surprisingly hiked at their last meeting, with the argument being a stronger-than-expected housing market – which is also the case in the US, where the housing market has experienced a slight uptick in recent months. So watch out for a more hawkish-than-expected Powell on Wednesday.

Jumping back to positioning, we are seeing some interesting divergences between non-commercial traders (what we usually look at) and institutions (Hedge funds and Asset Managers) – it looks like hedge funds are buying into the recession narrative amidst the market and fund flows celebrating the better-than-expected economic numbers. But without further ado, let’s jump into the data and give you a brief overview.

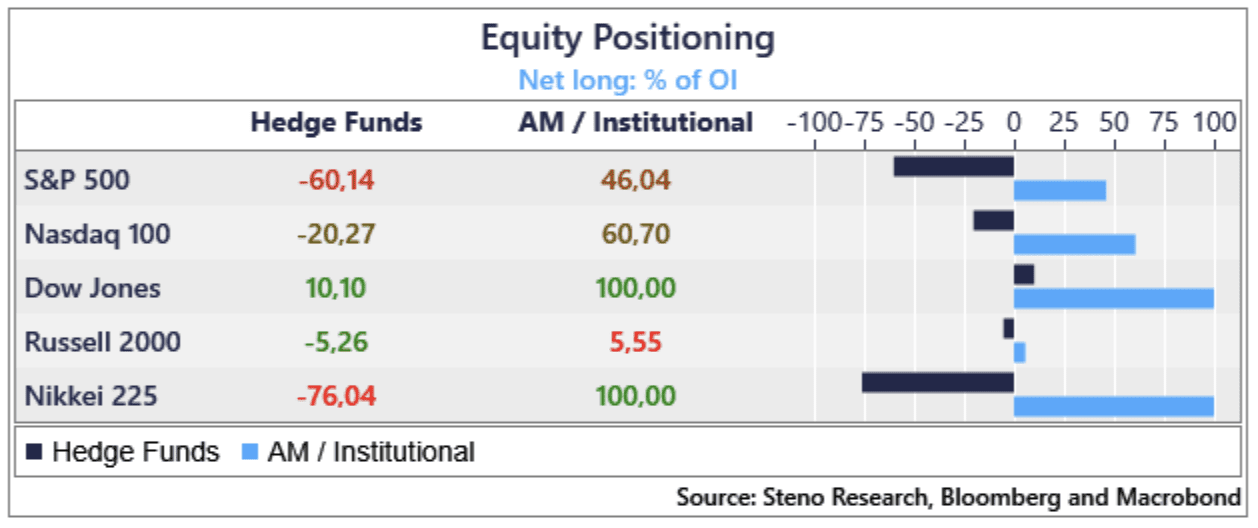

Equity Positioning

- Equity positioning is overall bearish amongst hedge funds but is likely a result of increased hedging in their client’s long portfolios. Basis trading is also still a factor.

- Nasdaq positioning is bearish, but more bullish than S&P 500 amongst hedge funds. The AI wave seems to have some legs to it still.

- On the other side of the Atlantic, Nikkei is not a favorite for hedge funds, but with the recent surge in the index, the data might simply reflect taking some profits and placing hedges.

- For asset managers, the overall picture is more or less the same. With the bullish positioning structure of asset managers, the overall picture is bullish, but we’re seeing the same tendencies in their positioning.

- Turning to fund flows, the message is very clear: Buy AI, short S&P 500. Will be interesting to follow how fund flows change when the AI rally is over.

Chart 1: Equity positioning amongst hedge funds and AMs

Bullish price action and the soft-landing narrative is still roaring in markets, and we thus wonder whether It’s just the AI bonanza that’s driving market sentiment, or if the big players have actually switched their views. We take a look at institutional positioning and fund flows in this week’s edition.

0 Comments