Positioning Watch – Everything better turn out the way markets want it

Hello everyone, and welcome back to our weekly positioning watch, where we dig into everything positioning and sentiment-related.

This week will be all about equities and fixed income, which seems to be running the show at current junctures – just give the gold chart a look, which jumped some 2% on the back of pivot hopes and strong buying activity this morning during Asian hours, while sellers were nowhere to be seen, but fast-forwarding 10-11 hours, gold is now down somewhere near 0.2%. A huge turnaround in markets which smells a lot like a short-squeeze or tight liquidity in the Asian markets today.

The overall positioning picture is still very much based on rate cuts and better (or at least stabilizing) economic conditions. Looking at current price action and positioning data, it sure looks like sellers have taken some time off in most markets, allowing market positioning to turn bullish to the extent last seen in 2021, but for current market positioning to hold true, we would basically need a perfect landing, which we are not exactly subscribing on.

Let’s jump straight to the data, running through positioning data, asset class by asset class.

Equities

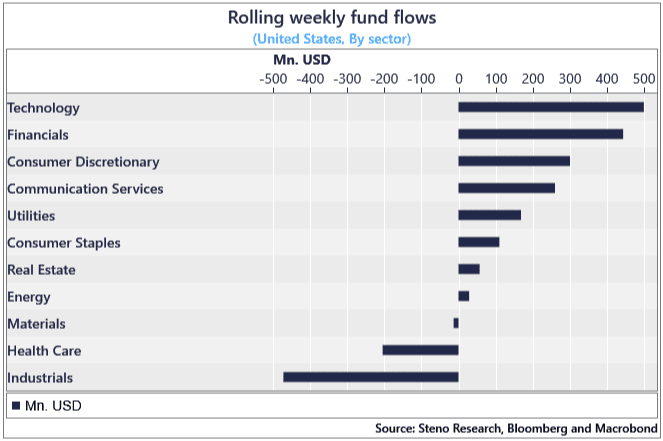

- Equity positioning remains VERY bullish, as the (bear)rally in equities has made investors believe further in the soft/perfect landing narrative. Industrials are being sold off a bit on the back of the weaker ISM manufacturing print, but high-beta sectors keeps performing on a fund-flow basis.

- The monthly change in the amount of respondents from the AAII survey responding with a bearish reading on equities have dropped to the lowest level seen in 10+ years, hinting of a further strengthening of the bullish sentiment. Current market positioning is starting to price in a perfect landing, not even just a soft one.

- Monthly equity fund flows across the big indices are on their biggest positive streak (where all indices have positive fund flows) this year despite very strong price action in H1. Santa came early this year?

Chart 1: Tech keeps performing, Industrials step back

Equity markets are as bullish as they were in 2021, while fixed-income markets continue to price Fed cuts in for Q2-2024. Are there reasons to worry about current market positioning? Find out here.

0 Comments