Portfolio Watch: Waiting for Godot, Powell and 7.30

We have added a few Europe skeptical bets to our portfolio lately with short GBP/USD and EUR/KRW based on the logic that the Asian malaise will spill-over to Europe with a time lag of 2-3 months. After all, Europe is still the region (ex. Oceania) with the largest relative export-ties with China.

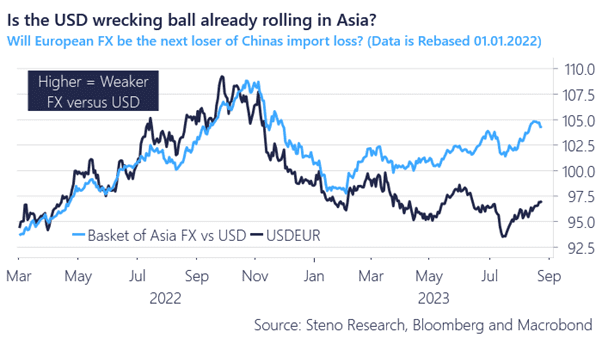

The USD wrecking ball has mostly terrorized Asian FX so far, while European FX has remained more resilient. We see this as one of the best relative value trades in macro terms right now and find EUR/KRW shorts attractive accordingly.

Chart 1: From an Asian wreckingball to a European wrecking ball

We see the risk outlook as extraordinarily binary at this juncture. Either the cyclical green shoots continue to get the upper hand or else we are likely headed for a recessionary type of asset environment.

0 Comments