Portfolio Watch: Short metals and Europe but long (US) liquidity sensitive assets

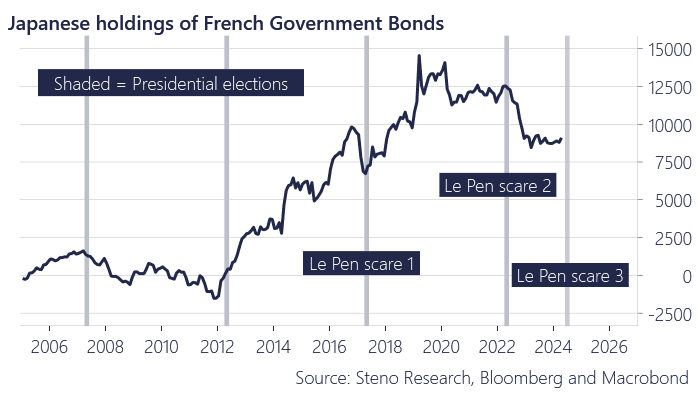

The European investment case has suffered a significant blow with the reintroduction of fragmentation risks due to the political turmoil in France. While we do not ultimately buy into the notion that it is a doomsday scenario for Europe if, for example, Le Pen comes into power, we have to face the reality that the market, especially in Asia, is moving in the opposite direction in terms of investment flow.

We are familiar with this scenario from the Le Pen scares #1 and #2 and the Meloni scare in 2022. Once the dust settles, investment flow tends to return, but we are still at least a few weeks away from reaching that point. For now, it is advisable to exit the European market.

Chart 1: Japanese holdings of French investments will suffer

The French election risks leave Europe uninvestable from an equity perspective for now, which leaves opportunities ahead in USD markets. We continue to see strong performance in USD liquidity sensitive trades paired with softness in commodities.

0 Comments