Portfolio Watch: Equities running out of Gas?

Welcome to our weekly Portfolio Watch! Every week, we assess the risk/reward across asset classes and explain our decisions in our own portfolio.

We once again note the great diversification effects from Energy over the past week. Front month Nat Gas has been on the move in the US despite relatively weak flow data, which is a strong harbinger of an improving underlying demand dynamic in the industrial sector due to the tick-up in orders books in cyclical- and energy intensive sectors such as Chemicals.

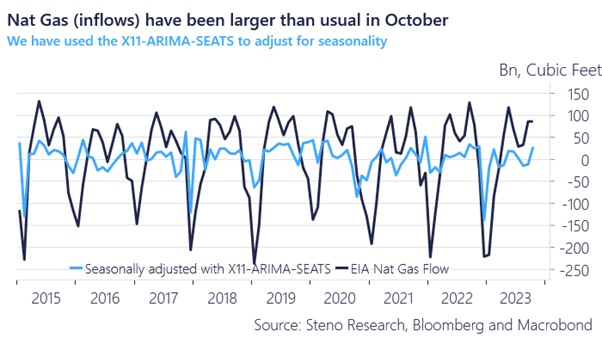

The only bad Energy demand side news October had to offer was in Nat Gas. Inflows exceeded normal by 28bn cubic feet due to hot temperatures leaving less than usual demand from households. If the weather is back in line with normal seasonality, we expect a further pick-up in demand relative to supply and negative flows compared to seasonality in November/December, which will likely prove to be price bullish for Nat Gas.

Our quantitative Nat Gas models are turning increasingly bullish by the day currently.

Chart 1: Nat Gas has performed in October despite a weak flow picture

We remain tilted towards a positive energy performance, a steeper USD curve, but now also risk sentiment weakness and some pockets of performance in European duration. Here is why!

0 Comments