Out of the box #3 – Italian banks the first domino?

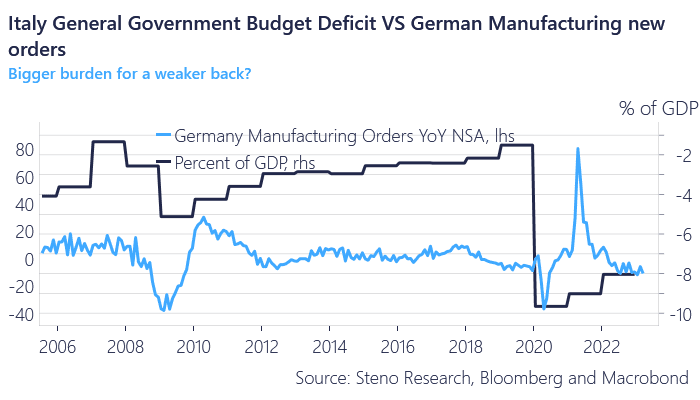

In my recently published article titled “Out of the Box,” I delved into a scenario of a potential resurgence of debt/creditor conflict (The Sovereign debt crises of the 2010s) as the European honeymoon of surging real growth and tight labor markets comes to an end. If I was asked to summarize the dark clouds ahead of us in one chart it would be this:

Chart 1: Italian Government budget deficit vs German Manufacturing new orders

Undoubtedly, the weight of this burden falls heavily on a vulnerable foundation if assistance is needed. The European Central Bank (ECB) finds itself partially constrained in its ability to assist localized issues due to the persisting inflation issue. More on this later.

Undoubtedly, the weight of this burden falls heavily on a vulnerable foundation if assistance is needed. The European Central Bank (ECB) finds itself partially constrained in its ability to assist localized issues due to the persisting inflation issue. More on this later.

The article primarily focused on the political ramifications of the ongoing monetary tightening. In Europe, governments are facing the daunting task of improving their finances in light of exacerbated budget deficits and high nominal debt levels. This necessitates either raising taxes or implementing expenditure cuts- classical austerity measures.

While everyone is looking at Europe for safety we are taking the other side of the trade. The unbalances of the Eurozone haven’t gone away and with inflation & dark clouds on the horizon, we question whether an indebted fragmented economy can hold fast as the economic winds turn unfavorable. Lagarde is running out of bullets and fiscal ammunition is in short supply

0 Comments