Money Watch – Is money growth BACK?

With the central bank tightening and continuing globally with Fed and ECB hiking rates 25bps and BoJ moving the YCC cap, we have a look at global money trends again today to see if correlations hold and what to expect next in global markets.

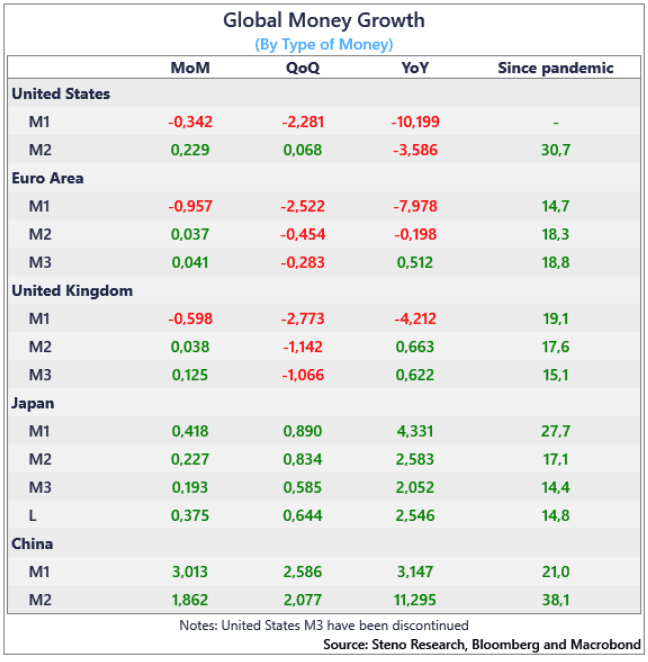

Global trends are more or less intact compared to our latest piece in March. M1 growth continues to weaken in the Western part of the world with both the EZ and US printing at levels below -7.5% with the UK hovering at more benign levels at -4.2%.

At the same time, Asia still shows strength with all money measures in positive growth territory in Japan and China, which could support further strength in Asian equities moving forward. The interesting observation here is also the fact that Japan is the only place amongst major countries/areas where M1 growth (the most liquid money) is increasing more than M2, which effectively means that money is left at demand deposits (M1) used for consumption rather than put into savings accounts and more illiquid (time)-deposits, with the opposite being true in the West. A trend that – if continued – will slowly but surely put pressure on the economy.

Chart 1: Global Money Trends

The tightening cycle continues for both the Fed, ECB and now also BoJ, and that means it’s time to revisit global money trends to see what might happen next.

0 Comments