Money Watch: Have people forgotten that everything is about money? Also the SVB case..

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

Since the outbreak of the pandemic, government spending, central bank easing and ultra-loose monetary conditions have put the economy (temporarily) back on track and saved it from a catastrophic de-route. But the stimulus and government spending used to save the economy from disaster might come back to haunt them, likely causing recessionary conditions later this year and one might argue that the things unfolding in banking space these hours is driven by global money trends.

We dig into the global money situation and zoom in on the US to provide an outlook for what we think is coming.

The current money situation

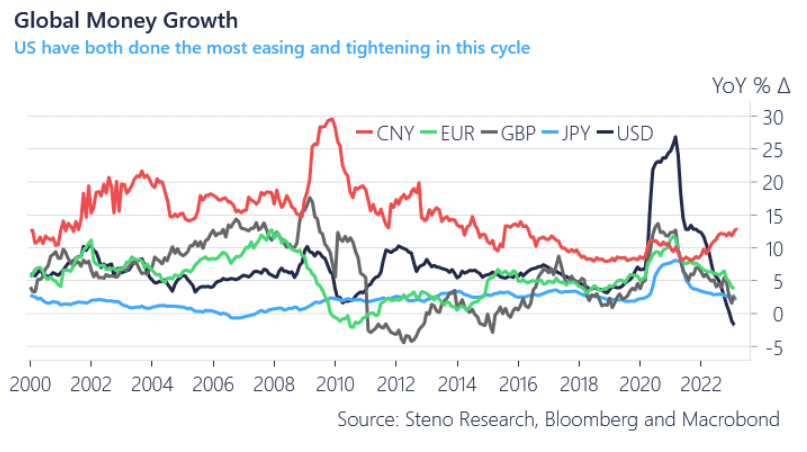

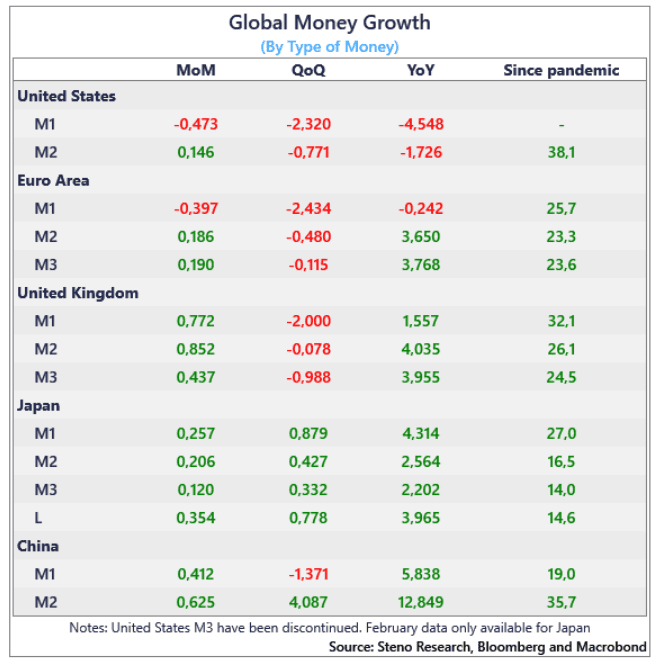

Money growth is slowing right about everywhere including in Japan after extreme increases during the early stages of the pandemic. The slowing money growth is part of a deliberate central bank policy in the US, in Europe, in the UK and maybe even in Japan. The Chinese money growth is on the other hand accelerating as part of the reopening policy scheme, which makes for an interesting contradiction between Western and Asian trends.

Chart 1: Growth in broadest monetary measure across most popular currencies

The US is typically in the driver’s seat when it comes to global macro, and monetary policy is no exception. Powell has outperformed Bailey, Kuroda and Lagarde both when it comes to increasing the money supply, but also in decreasing again, claiming the title as the biggest dove but also the biggest hawk since 2020.

The US is also the only place out of the five jurisdictions where the broadest money supply is decreasing in local currency terms, but the Euro zone M1 momentum for example looks very tight as well. The decrease in M1 in the US is of an extent not seen in many many decades, which arguably makes for an interesting experiment in the year ahead. Will a decreasing money supply wreak havoc with our hyper financialized system?

The decrease in M1 in Europe and in the US might also be a reason why we start to see more and more canaries in the global economic coal mine with the banking stress around Silicon Valley Bank as the latest example.

Chart 2: Global money growth, by type of money, % change

Most people tend to agree that the amount of money in an economy affects economic conditions. More money makes consumers buy more goods and services, and the excess demand leads to increasing prices.. but what happens when we destroy USDs as we currently do? More SVB cases show up!

0 Comments