Asset Allocation Watch: Still early innings for US cyclicals?

Each month, we offer our best assessment of the current and coming month’s macroeconomic conditions and weigh risks against reward – using both our Macro Regime Indicator Framework in combination with the interactive Structural Asset Allocation Model.

Coming into August, we wrote that:

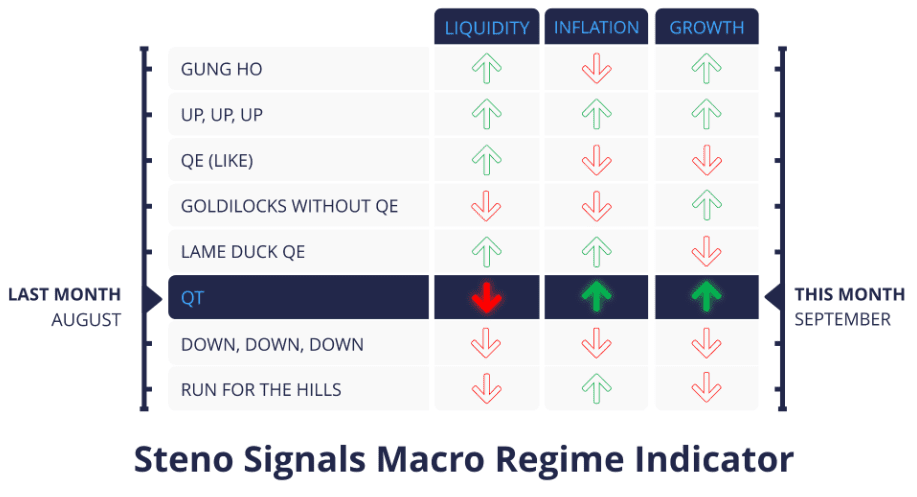

“We have (over the prior month) grown in confidence that the Manufacturing cycle is actually bouncing and that portfolios accordingly have to adjust. This month, we see 1) rising headline, but falling core inflation, 2) rising PMIs and 3) lower liquidity – the so-called ‘QT-regime’.”

Looking ahead, we do not expect sudden shocks or changes to the current conditions. We remain firm in our views around manufacturing taking center stage while services weaken, as well as an increased risk of a marginal increase in inflation according to some measures. No need to sound the alarm bells around liquidity yet.

This month’s Steno Research Macro Regime: Still on the QT-spectrum

While liquidity was on everyone’s lips 6 months ago, the net effects have been somewhat benign. Meanwhile, PMIs and inflation seem to be running the show. It appears that services are weakening coincidently with manufacturing showing strength. Board or aboard cyclicals then?

0 Comments