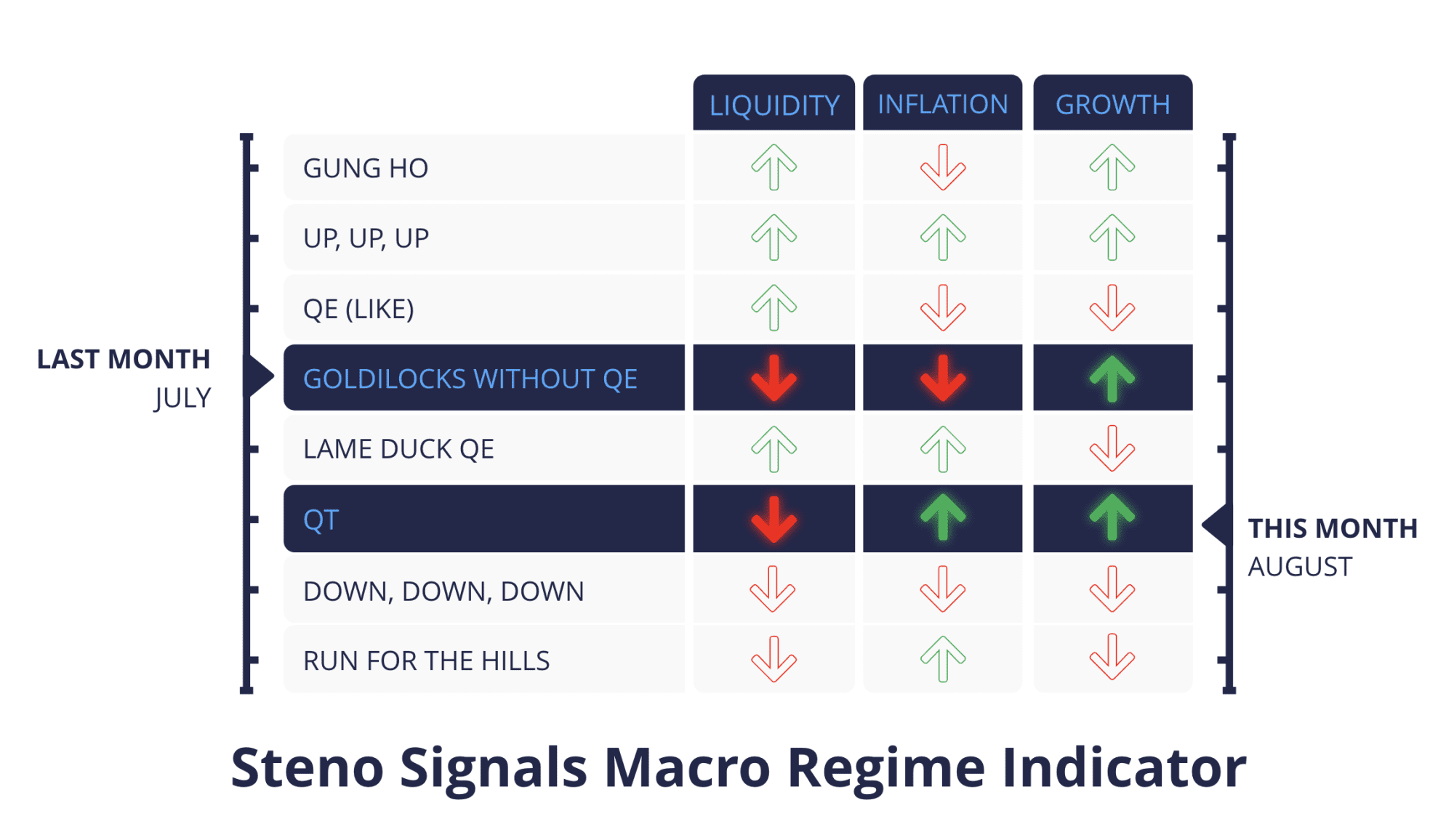

Macro Regime Indicator: PMIs to drive price action together with headline inflation

Every month, we assess the risk/reward in asset allocation via our Macro Regime Indicator framework, where we use our asset allocation model to provide input for our thought process and positioning ahead of the new month’s trading.

In early July we wrote that:

“We remain a bit split on whether we will see a pronounced change of the Macro Regime from “down, down, down” (in liquidity, inflation and growth) to Goldilocks without QE with inflation down, liquidity down and growth slightly up. Our portfolio will hence combine the best of the two regimes for the month of July. EM bond longs, long USD (versus Asia), high beta USD equity (Discretionary/Tech). We will consider adding a position in the Energy space as a diversifier in the coming days should the Manufacturing sector rebound.”

We have since grown in confidence that the Manufacturing cycle is actually bouncing and that portfolios accordingly have to adjust. This month see 1) rising headline, but falling core inflation, 2) rising PMIs and 3) lower liquidity – the so-called “QT-regime”.

We will unpack how our asset allocation model looks at this regime towards the end, but let’s first look at why inflation, PMIs and liquidity are likely to move as they are.

Chart of the month: From Goldilocks without QE to being on the verge of the QT regime

We have entered a macro regime where PMIs and headline inflation outpace liquidity in importance. The pick-up in Manufacturing PMIs paired with the potential higher headline inflation provides some interesting guidance for portfolio managers.

0 Comments