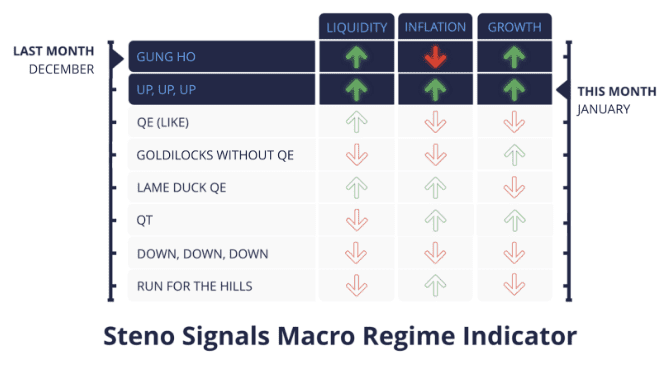

Macro Regime Indicator: Liquidity is everything in January

New month, new regime, which means a new asset allocation for the month ahead. The turn of the calendar once again calls for us to assess our outlook for the 3 main variables of interest: Liquidity, inflation and growth and feed them into our Regime Model and Asset Allocation tool that spits out the Sharpe Ratio optimizing portfolio given the assumptions about the variables of interest. Remember that you can feed the model with your own forecasts to see which baskets to put your eggs in.

Without further ado, let’s jump into our view on the coming month!

Coming into December, we wrote that:

“For December, we see rising liquidity due to rallying treasuries and rising SOFR-Fed futures spreads, consequently depleting the ON RRP faster than expected. Inflation looks primed to still modestly recede as interest rates continue to weigh on corporations, employment and not least consumer spending. While PMI figures remain clearly in contracting territory, we remain optimistic for some cyclical improvements in growth.”

The model performance has accordingly been extremely solid through December, but the start of the year has been a bit more challenging to say the least.

For January, rising liquidity will be the overarching driver of short-term movements in asset prices as increased issuance in January moves money from the ON RRP into government accounts used for spending. Our models are hinting at a 3.7% increase in January alone! For inflation, we expect a modest increase in headline prices in line with market expectations with conflicts in the Red Sea likely to spill over to US CPI. For growth, our models suggest a slight uptick in growth over the course of January with lagged effects of USD weakness looking to provide tailwinds for the manufacturing sector.

To sum it up, we land in the ‘Up, Up, Up’ regime:

This month’s Steno Research Macro Regime:

Our models hint of a HUGE increase in liquidity in January due to issuance and outflows from the ON RRP facility, which might provide some fuel for the soft landing rally in equities and bonds. See what our Asset Allocation tool suggests for the month ahead here.

0 Comments