Macro Regime Indicator: What technically rising liquidity means for your portfolio

With the turn of the calendar, it’s once again time for our monthly assessment of the current and upcoming macroeconomic circumstances. To carry out this evaluation, we utilize two critical tools: our Macro Regime Indicator framework and the interactive Structural Asset Allocation Model. These integrated resources enable us to establish a portfolio allocation that is empirically supported, taking into account the prevailing macroeconomic conditions and the driving factors within financial markets.

The model thoroughly analyzes all asset classes, identifying the optimal risk-to-reward in terms of Sharpe ratios based on the inputted macroeconomic assumptions. Let’s have a look at the details!

Coming into November, we wrote that:

“For November, we expect improvement in the US manufacturing cycle. Despite the latest ISM PMI of 46.7, our models still suggest PMI’s above consensus. With regards to inflation, the Euro area is firmly approaching 2%, and so is US inflation – albeit with a much more cumbersome trajectory with room for upside surprises. The quarterly refunding report was far from the issuance-bazooka that some had expected, but paired with QT and tight credit availability, liquidity ought to dwindle further.”

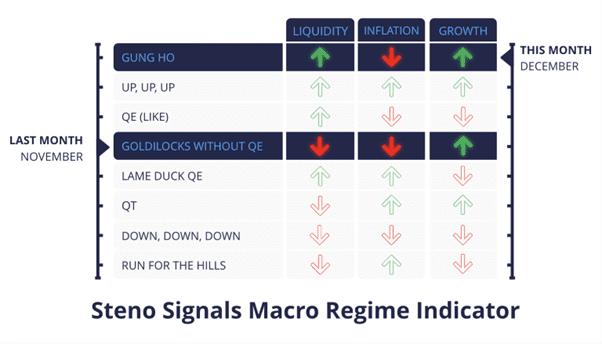

For December, we see rising liquidity due to rallying treasuries and rising SOFR-Fed futures spreads, consequently depleting the ON RRP faster than expected. Inflation looks primed to still modestly recede as interest rates continue to weigh on corporations, employment and not least consumer spending. While PMI figures remain clearly in contracting territory, we remain optimistic for some cyclical improvements in growth.

In conclusion, we expect liquidity up, inflation to modestly down, and growth relatively better: The regime we’ve labeled ‘Gung Ho’.

This month’s Steno Research Macro Regime:

Markets keep celebrating bad news, but are they right or wrong, and can the current macro regime give any explanation on these recent developments? As always, we assess liquidity, inflation and growth to ultimately showcase our model’s allocation suggestions.

0 Comments