Macro Nugget: Why the price at the pump matters for inflation expectations

When oil prices increase, so does CPI by nothing else than through its direct influence on retail energy prices. This effect holds true when assuming all other prices remain constant.

Naturally, we tend to anticipate that a surge in oil prices would ripple through to affect other prices by hiking up respective costs basis: Two obvious variables that mechanically should reflect this are transportation costs and production costs: Higher input prices –> Higher costs –> Higher end-user prices. Simple textbook stuff.

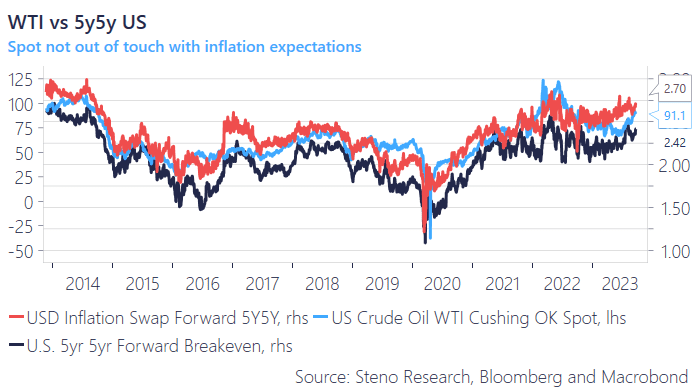

But interestingly, the market appears to incorporate every fluctuation in oil prices into longer-term inflation expectations. The exact reason for this phenomenon remains unclear in the literature, but the correlation is undeniable.

As demonstrated in the chart below, Inflation expectations in the US – both in swap and breakeven terms are largely in sync with the WTI spot

This may be a MAJOR issue for the long bond bet. Find out why below..

Chart 1: WTI vs 5y5y US

With the recent surge in oil prices due to supply constraints, we highlight the contrasting market impact in the US and the Eurozone. Our Monday Macro Nugget available below

0 Comments