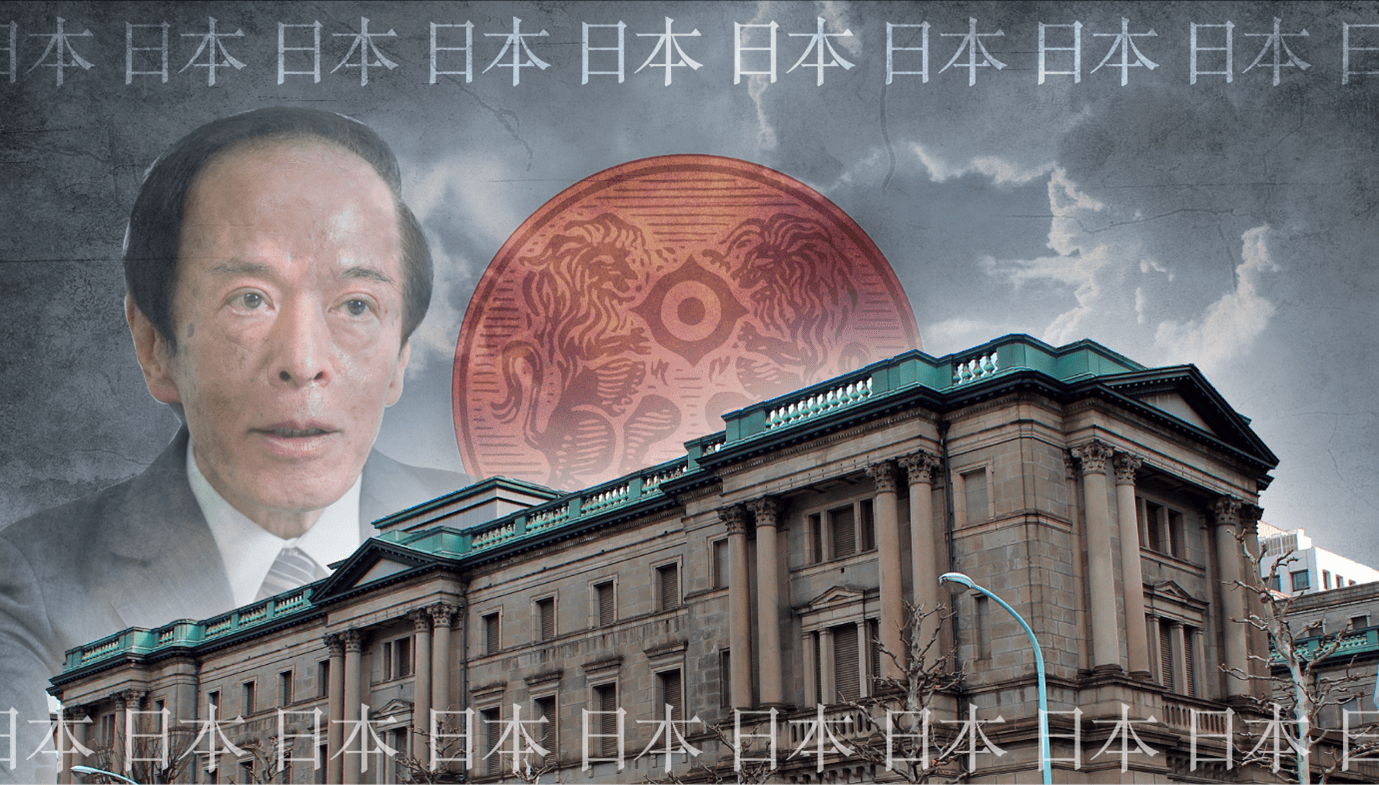

Japan Watch – Buy the JPY? >150 more likely than <130 in USDJPY

The Japanese bubble of low-interest rates and inflation has been a hot topic throughout the whole Fed hiking cycle, as the ultra-loose monetary policy conducted in Japan leaves a textbook-like carry trade in shorting the Yen against basically every other currency with positive interest rates.

With the recent rally in Yen and JGB yields, it might therefore be time to revisit the Asian islands to see if something has structurally changed, or if the Yen will remain the most shorted currency worldwide. If now is the time to load up on the Japanese currency, it could be one of the greatest trades for every PM and investor out there – as you say, the higher you have to climb, the further you have to fall.

Japan is normally decoupled from the rest of the world inflation-wise but the supply shock effects from the pandemic has made its way to the Asian country as well. For the first time in decades the Bank of Japan finally got what they wanted – consistent and positive inflation – but it’s not really driven by the monetary policy, which looks to have negligible effects on inflation.

Therefore the question remains how to get higher and positive inflation and inflation expectations anchored in the economy? According to BoJ the answer relies on the newly released cash earnings, which hints of the overall wage growth in Japan. While LNG prices and supply shock effects are transitory, consistent increases in wages are after all what makes inflation sticky – and higher cash earnings increase the likelihood that inflation is here to stay for good. Was a pandemic really all they needed?

Chart 1: Inflation is getting anchored in the economy

With the recent move in swap rates and the JPY, we have once again looked into Japan to find out when BoJ will do something about their policy and if the Yen is a viable option for your portfolio. JPY looks more like a sell than like a buy here.

0 Comments