G3 Watch: Timing the first rate cut

Fed: Trading the X13-ARIMA-SEATS fallacy

Powell shot down the March base-case cutting hopes yesterday and market pricing has accordingly homed in on May as the first cut accordingly.

We tend to agree that May is more likely than March due to the Red Sea implications for goods inflation, but how do we trade that scenario from here?

There is an interesting short-term seasonality perspective to be aware of in USD markets.

The outlier filter in the X13-ARIMA-SEATS has been very much put to work since 2020, due to large volatility in December/January caused by lockdown/reopening patterns paired with the resurgence of mechanical inflation adjustments leading to an increase in spending power among households in January.

Last year saw the biggest seasonal adjustments upwards (due to lockdowns in January in years prior). Paired with historical COLA adjustments for households, which made for a super strong data cocktail in January 2023.

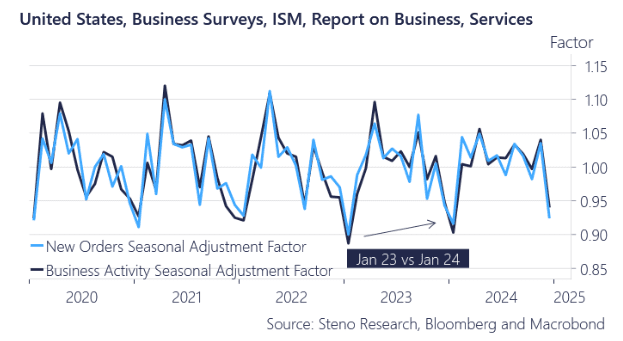

Adjustment factors for 2024 will be smaller due to revisions in the X13-ARIMA-SEATS filters. This effect will account for more than 1 index point in ISMs in January 2024 and make January 2024 look oddly weak.

Chart 2: ISM adjustment factors are less material in 2024

The X13-ARIMA-SEATS seasonal adjustment methodology has generally suffered with the rising volatility since the pandemic.

Large COLA-adjustments have introduced a new layer of seasonality in US key figures as households are relatively much better off in Q1 than in Q4, which is visible when we account for the outlier filter in the methodology.

Taking the retail sales as an example, we have seen a tendency for Q1 numbers to overshoot actual trends, while Q4 numbers have been underestimated. Q4-2023 consumption was much stronger than it appeared.

The first rate cut is a timing question from both the Fed, the ECB and the BoE now. How do we trade the first cut and why are seasonality issues important to bear in mind? Read along here.

0 Comments