FX Watch: The world needs a Riyadh accord more than a Plaza Accord 2.0

“I’ve said on many occasions that I think a market-determined value for the dollar is in America’s interest. And I continue to feel that way.” Janet Yellen, October 2022

Janet Yellen basically wrote off the possibility of a Plaza Accord 2.0 (coordinated action against a strong USD) in Q4-2022 when the energy crisis was at its peak with a strong USD against almost all peers.

The current situation looks mostly reminiscent of last year, why we struggle to see why the US authorities should alter their view. As long as US inflation is running above target, the US is not incentivized to participate in a coordinated USD weakening.

The main issue is that the USD is strong due to 1) relative yield spreads and 2) relative energy balances. You cannot solve the latter via monetary policy action, making the road to a weaker USD a lot trickier without help from Riyadh.

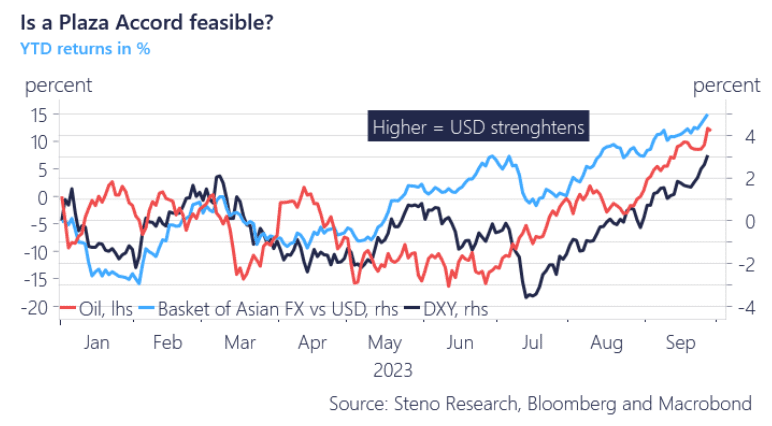

Chart 1: A strong USD against EVERYTHING

Lots of talk around a too-strong USD, especially in Asian markets. The issue is that the move in the USD is driven by BOTH monetary policy and relative energy balances. It is hard to make a Plaza Accord without a Riyadh accord.

0 Comments