Fixed Income Watch: Zooming in on the curve steepening

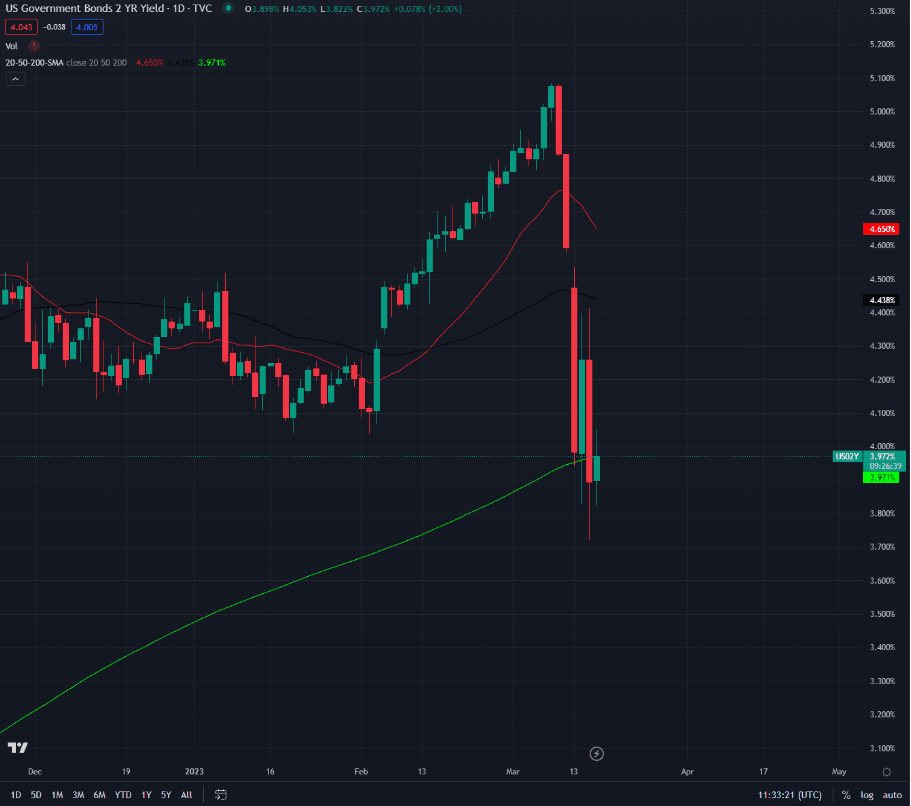

The below picture sums up the last few days pretty well. We have seen absolut batshit craziness in front end yields across the continent. On the back of this volatility we thought it would be a good idea to already now look at what a curve steepener from inverted levels means for risk assets. Of course these trades first become relevant when the dust has settled. Right now it is one big scrabble.

Firstly we define a curve steepener as an inverted curve which steepens above 0 in 2s10s. We see that the resteeping of the curve happens almost simultaneously with the Fed’s first rate cut, which flags a recession. Now, currently the curve is…

What happens when the curve steepens? It is bad good news for commodities, mixed news for equities and often temporarily good news for the USD except against JPY. Here is why..

0 Comments