Fed Watch: Why should the Fed abandon the planned year-end hike?

Welcome to our short and sweet Fed preview.

No one expects policy action from the Fed this week, but Powell could decide to reiterate that the dot plot remains intact given the most recent information received. We doubt that Powell will bring about a strong guidance for a December hike, but unless the wheels come off, it’s very likely that they will be tempted to deliver that hike come December.

We have not aborted our recessionary outlook for 2024, but we merely reflect on the information available to the FOMC at this point, which looks hawkish on aggregate.

Let’s have a look at the developments since June/Sep (the two latest dot plot updates).

Inflation:

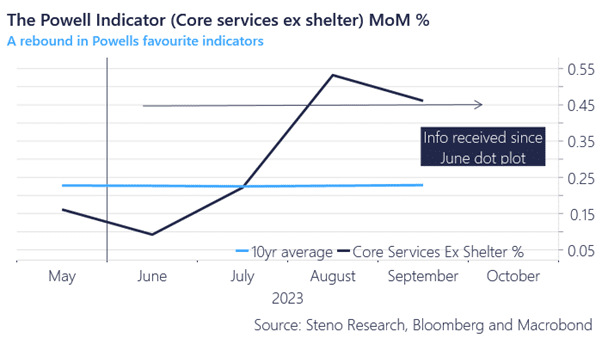

The Powell-indicator (core services ex shelter) remains hotter than anticipated and runs at >5% annualized levels in momentum terms. This is much hotter than in June and it remains an issue after the Fed decided to keep the soft guidance of one more hike intact in September.

Chart 1: Inflation is running hotter than anticipated

Why should Powell abort the planned hike from the dot plot when everything is improving relative to the base case in the US economy? We are not writing off a Q1-Q2 recession, but the soft/hard evidence is not there for the FOMC members.

0 Comments