European Deposits: US turmoil on tour?

As US banks and their vulnerability to deposit flights has been in the limelight recently, we thought it would make sense to look deeper into whether a similar scenario could unfold in Europe – or rather try to scope the probability of such. In this edition of the ‘Watch Series’ we’ll make European banks the subject of analysis and pull back the curtains on movements in both corporate and household deposits respectively.

Let’s dive right in.

A broad look at deposits

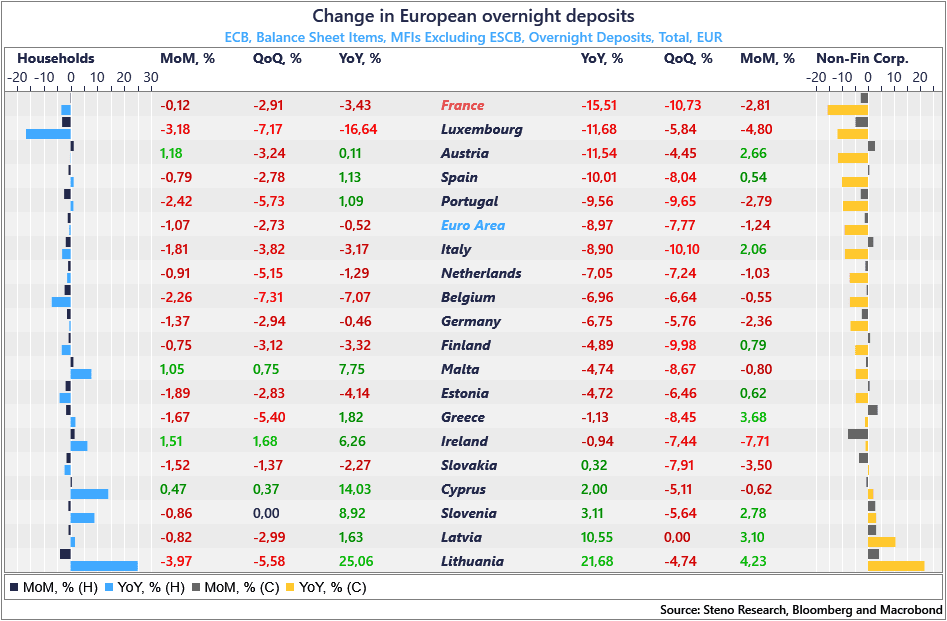

The US banking turmoil, by and large offset by a confidence crisis and deposit flights, is no distant memory, and data from European peers show some of the same worrying tendencies. While corporations have decent options, retail access to alternatives for European depositors is worse relative to those in the US. This skew is clearly reflected in the overview of movements in deposits below. On average in the Euro Area, corporate deposits have shrunk close to 9% YoY – as of March -, while households have only pulled 0.52% in the same period. To put these numbers into perspective, the deposit base of US commercial banks is currently down 4.95% on average relative to a year ago (Fed). Maybe Europe is not shielded from deposit flights to the extent that many claim…

As a deferred effect from debt issuance,…

Chart 1: European depositors too have fled the scene

Several US regional banks fell victim to the waning confidence from depositors who ultimately pulled the plug. Are European banks really safeguarded by better legislation, or are we taking comfort in a false sense of security?

0 Comments