EUR Inflation Watch – It’s all about energy and food

Hello everyone, and welcome back to our usual inflation outlook for the Euro Area inflation coming out on Thursday. The format will – as always – be short and sweet with loads of charts so you will be well prepared for the upcoming inflation report.

The HICP measure in Europe has already started turning deflationary in last month’s report for July (although typical in July due to NSA numbers), with Energy as the main driver on the back of falling Natural Gas prices.

This month will likely be no exception with base effects still affecting the landscape in energy prices, but there is a risk of rising energy prices due to the small run in crude prices. And the other main driver of inflation previously – food prices – are soon turning deflationary as well based on our leading indicators.

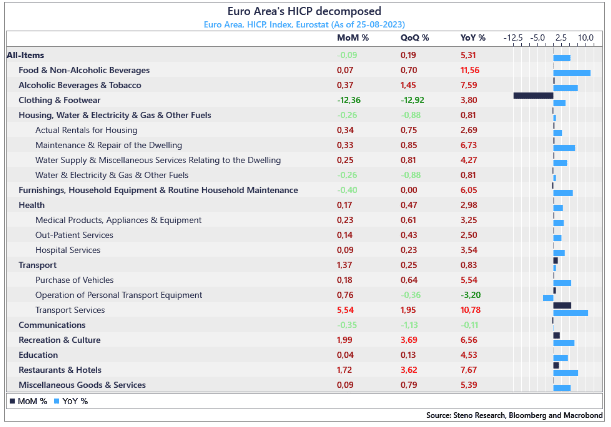

As always we have attached a decomposition of last month’s inflation report below. It’s still services that keep inflation too high for comfort, but other than that, most components scream disinflation on a MoM and QoQ basis.

The MoM consensus estimate is 0.4% in August, which is something we lean clearly on the low side of. August is typically a slightly “firmer” month in non-seasonsally adjusted terms, but 0.4-0.5% MoM inflation would be a very hot number in historical terms for August (despite the 0.6% MoM print for August 2022). The base effects will grow even larger in September and October due to very large monthly sequential price increases in energy last year.

Let’s show a bunch of charts on why.

Chart 1: EU HICP Decomposed

With the inflation report coming out this Thursday, we of course provide you with an actionable take on the path for EZ HICP and whether now might be the time to buy euro bonds

0 Comments